Loading

Get Ph Bir 1601-e 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1601-E online

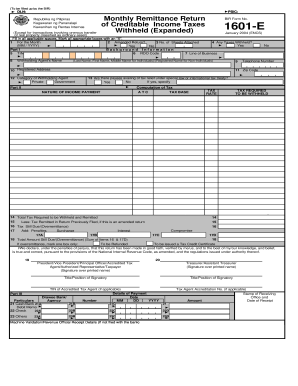

The PH BIR 1601-E form is essential for withholding agents required to report and remit creditable income taxes withheld. This guide outlines a user-friendly, step-by-step process to complete this form online, ensuring you understand each section and field.

Follow the steps to accurately complete the PH BIR 1601-E form online.

- Use the ‘Get Form’ button to access the PH BIR 1601-E form and open it in your preferred online editor.

- Begin by entering the applicable month and year in the ‘For the Month’ field. Ensure the format is MM/YYYY.

- In Part I, provide your Taxpayer Identification Number (TIN), Revenue District Office (RDO) code, and line of business.

- Select the category of withholding agent by marking either ‘Private’ or ‘Government’.

- In Part II, compute the total tax required to be withheld and remitted. Fill in each corresponding field with the appropriate amounts.

- Complete the declaration at the bottom by having the appropriate officers or representatives sign above their printed names.

- After filling out all fields, review the form thoroughly for accuracy, then save your changes.

Start filling out your PH BIR 1601-E form online today to ensure compliance and streamline your reporting process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The return period in BIR forms varies depending on the specific form being filed. For instance, some forms may need to be submitted monthly, while others are filed quarterly or annually. It is crucial to stay informed about the specific deadlines related to the PH BIR 1601-E and any other relevant tax forms to avoid penalties and ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.