Get Ky Ui-3 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY UI-3 online

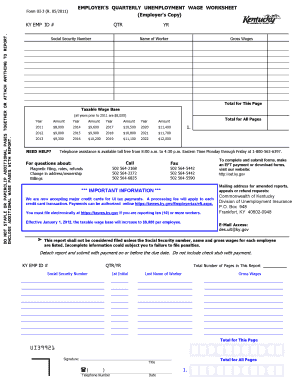

Filling out the KY UI-3 form is essential for employers to report quarterly unemployment wages accurately. This step-by-step guide helps users navigate the online process, ensuring all necessary information is submitted correctly and efficiently.

Follow the steps to complete your KY UI-3 form online.

- Press the ‘Get Form’ button to obtain the KY UI-3 form and open it in your preferred online editor. Ensure you have the correct version ready for the current fiscal year.

- Complete the sections for the company's information, including the KY employer identification number (KY EMP ID #) and the year and quarter for which you are filing. This ensures proper tracking and compliance.

- List each worker's details, including their social security number, first initial, last name, and gross wages earned during the quarter. Accurate information is crucial to avoid penalties for incomplete reporting.

- Calculate the total gross wages for all employees. This total should be entered in the designated field and will serve as the basis for your tax calculations.

- Refer to the table provided within the form to determine the taxable wage base for the reporting year. Ensure you adhere to the reported amounts to avoid unnecessary penalties.

- Use the totals from your calculations to fill out the lines for excess wages, taxable wages, tax due, interest due (if applicable), and any penalties incurred. Each of these calculations contributes to your overall submission.

- Review all entered information to confirm accuracy. Double-check for completeness to prevent issues with filing. Make sure all lines are filled as instructed, particularly those involving gross wages and total amounts due.

- Once all information is accurately filled in, save your changes. You may download the completed form, print it for your records, or share it via email if necessary.

Complete your KY UI-3 form online today to ensure timely and accurate reporting!

UI on your paycheck stands for Unemployment Insurance. This deduction is used to fund state and federal unemployment programs, including benefits you may receive if you become unemployed. Understanding UI is essential for navigating your benefits effectively, particularly the KY UI-3 system. If you have further questions or need assistance regarding your deductions, UsLegalForms can provide resources to help you comprehend your benefits better.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.