Loading

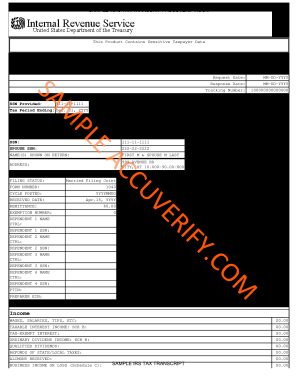

Get Irs Tax Return Transcript

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Tax Return Transcript online

Understanding the IRS Tax Return Transcript is essential for both tax preparation and verification purposes. This guide will provide you with clear instructions on how to fill out the form accurately and efficiently.

Follow the steps to effectively complete the IRS Tax Return Transcript.

- Press the ‘Get Form’ button to obtain the IRS Tax Return Transcript and open it in your document editor.

- The first section includes the request date and response date. Enter the appropriate dates in the format MM-DD-YYYY.

- Input your social security number (SSN) where indicated. This is essential for your identification.

- Provide the name(s) shown on the return, including both you and your partner's names if applicable. Ensure spelling matches official documents.

- Fill in your address accurately, as it is essential for correspondence and record-keeping.

- Indicate your filing status, such as 'Married Filing Joint', as this affects tax calculations.

- List your income sources in the income section, including wages, taxable interest, and other relevant financial details.

- Review the adjustments to income section carefully, ensuring that any deductions or adjustments you qualify for are reported.

- Complete the tax and credits section by entering any applicable credits or tax amounts.

- Ensure that any payments made or refunds anticipated are noted correctly in the payments and refund section.

- Finally, review all sections for accuracy before saving your changes, downloading or printing the document, or sharing as necessary.

Complete your IRS Tax Return Transcript online today for a straightforward filing experience.

Related links form

To fill out your tax transcript for FAFSA, first obtain your IRS Tax Return Transcript to gather the necessary information. Use the details about your income and tax filing status when completing the application. This ensures that your FAFSA is complete and accurate, helping you secure financial aid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.