Loading

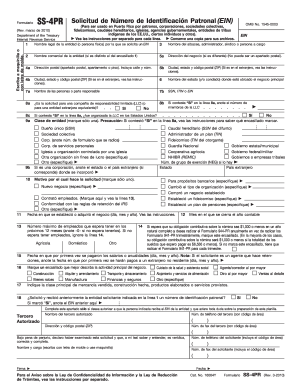

Get Irs Ss-4pr 2010

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS SS-4PR online

Filling out the IRS SS-4PR form is an essential step for obtaining an Employer Identification Number (EIN) in Puerto Rico. This guide will provide you with clear instructions and detailed information to successfully complete the form online.

Follow the steps to fill out the IRS SS-4PR form online:

- Press the ‘Get Form’ button to obtain the IRS SS-4PR form and access it in the editor.

- Complete the legal name of the entity or individual requesting the EIN in the first field.

- If applicable, enter the trade name of the business in the subsequent field.

- Fill out the business address, ensuring it's not a P.O. Box, and provide the necessary postal information.

- Provide the name of the state or county where the main business is located.

- Enter the responsible party's name and either their Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or another EIN.

- Indicate whether the application is for a Limited Liability Company (LLC) and provide the number of members if applicable.

- Select the entity classification by marking only one box corresponding to your entity type.

- State the reason for applying for an EIN by choosing one option that best fits your situation.

- If relevant, indicate if the entity previously requested and received an EIN. If yes, enter the previous EIN.

- Complete any additional fields necessary for the authorized third party, if applicable.

- Review all provided information for accuracy before submitting the form.

- Once satisfied with the entries, save the changes, download the completed form, or prepare to print and share it.

Take the next step and complete your IRS SS-4PR form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can easily download your SS-4 form from the IRS website. They provide the latest version of the form in PDF format for your convenience. Additionally, you can find helpful instructions on completing the form. For a more guided approach, US Legal Forms offers resources and templates that can enhance your filing experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.