Get Irs Ss-4 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS SS-4 online

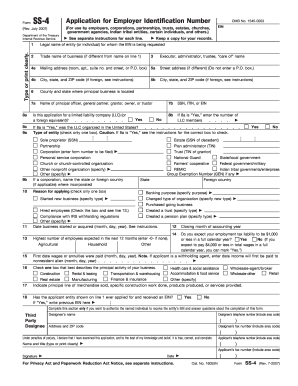

Filling out the IRS SS-4 form is an essential step for entities and individuals requiring an Employer Identification Number (EIN). This guide provides clear instructions on how to accurately complete the form online, ensuring a smooth application process.

Follow the steps to complete the IRS SS-4 online

- Click ‘Get Form’ button to access the IRS SS-4 form and open it in the editor.

- Enter the legal name of the entity or individual on line 1 as it appears on legal documents.

- If applicable, provide the business's trade name on line 2, if it differs from the legal name.

- Complete line 3 with the name of the executor, administrator, trustee, or other representative if relevant.

- Fill in line 4a with the mailing address, including room, suite number, or street address, or P.O. box, wherever correspondence should be sent.

- If the street address differs from the mailing address, fill that in on line 5a, and provide the corresponding city, state, and ZIP code on lines 4b and 5b.

- Complete line 6 with the county and state where the principal business location will be.

- On line 7a, enter the name of the principal officer, general partner, or owner of the entity.

- Indicate if the application is for a limited liability company (LLC) by selecting 'Yes' or 'No' on line 8a.

- If 'Yes' is selected, fill in the number of LLC members on line 8b.

- Provide the applicable SSN, ITIN, or EIN on line 9a, as relevant.

- Select the type of entity by checking the appropriate box on line 10.

- Indicate the reason for applying on line 11 by checking one box and providing any necessary details.

- If the business has been started or acquired, fill in the appropriate date on line 12.

- Complete line 13 regarding the first date wages were paid, if applicable.

- On line 14, indicate the expected employment tax liability for the upcoming year.

- Enter the expected number of employees on line 16.

- Provide any necessary details on line 17, specifying the principal activity of the business.

- If applicable, answer line 18 regarding whether the entity has previously applied for an EIN, and provide that number if applicable.

- If you wish to authorize a third party to receive the EIN, fill in the Third Party Designee section.

- Carefully sign and date the application, ensuring accurate declaration of all information provided.

- Once completed, save your changes, and download or print the completed form for your records, if needed.

Complete your IRS SS-4 form online today to secure your Employer Identification Number efficiently.

Get form

Related links form

Yes, you can apply for an EIN directly from the IRS using the IRS SS-4 form. This application can be completed online, via mail, or by fax, depending on your preference. Remember that the process is generally straightforward, and submital timing can influence how soon you receive your EIN. If you're looking for assistance, US Legal Forms offers resources that can help simplify your application process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.