Loading

Get Irs Publication 1281 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Publication 1281 online

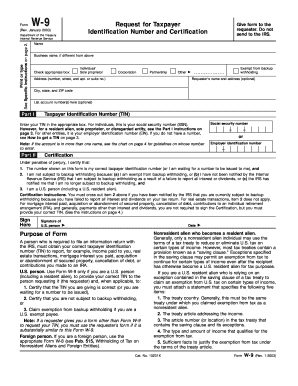

IRS Publication 1281 provides essential guidelines regarding backup withholding requirements when there are missing or incorrect Taxpayer Identification Numbers (TINs). Follow this guide for a concise, step-by-step approach to completing the form online.

Follow the steps to complete the IRS Publication 1281 form online.

- Click the ‘Get Form’ button to access the IRS Publication 1281 form.

- Begin by filling out the appropriate identification fields. Enter your name and address as the requester of the form.

- Identify the payee’s name and TIN that corresponds with the payment records. Ensure accuracy to avoid issues with IRS matching.

- Indicate the type of payment by selecting the relevant checkbox, such as interest, commissions, or other reportable payments subject to backup withholding.

- If applicable, attach any necessary documentation, including previous notices like the CP2100 if you have received one.

- Review all entered data for accuracy and completeness. Make corrections where necessary.

- Once all fields are filled out correctly, save your form. You may download, print, or share it as needed.

Complete your IRS Publication 1281 form online today to ensure compliance with IRS regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can mail Form 1096 to the IRS, but ensure you send it to the correct address based on your location. It's recommended to use certified mail for tracking purposes. If you're unsure about mailing procedures, consult IRS Publication 1281 for comprehensive information and guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.