Loading

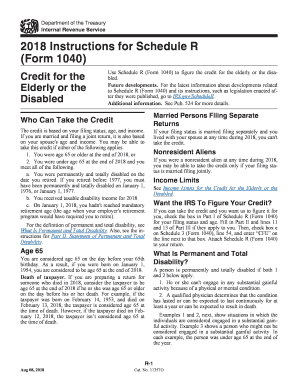

Get Irs Instructions For Schedule R (1040a Or 1040) 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions for Schedule R (1040A or 1040) online

Filling out the IRS Schedule R allows users to claim a credit for the elderly or disabled. This guide provides clear, step-by-step instructions to help users navigate the form effectively online.

Follow the steps to successfully complete Schedule R online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Review Part I of the form to determine eligibility. Check the relevant box based on your filing status and age as explained in the instructions.

- If applicable, complete Part II, which includes providing a statement of permanent and total disability. Ensure that a qualified physician certifies your condition.

- Proceed to complete Part III, which involves calculating your credit based on your income and the credits you qualify for.

- After completing all relevant parts of the form, review your entries for accuracy. Make any necessary adjustments.

- At the end of the process, you can choose to save changes, download the form, print it, or share it as needed.

Start filling out your IRS Schedule R online today to claim your credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The primary difference between the regular 1040 and the 1040SR is that the 1040SR is designed specifically for seniors, aged 65 and older, providing a simplified filing experience. Although both forms serve similar purposes, the 1040SR has larger print and fewer line items. Ensure to follow the IRS Instructions for Schedule R (1040A or 1040) for clarity on which form best suits your needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.