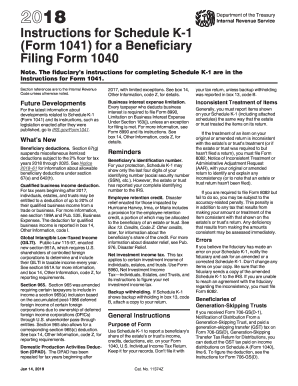

Get Irs Instructions 1041 - Schedule K-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1041 - Schedule K-1 online

Filling out the IRS Instructions 1041 - Schedule K-1 online can seem daunting, but with a clear understanding of each component, the process can be straightforward. This guide provides step-by-step instructions to help you accurately complete the form and ensure compliance with tax regulations.

Follow the steps to complete your IRS Instructions 1041 - Schedule K-1 online:

- Click the ‘Get Form’ button to access the IRS Instructions 1041 - Schedule K-1 form and open it for editing.

- Review Part I, which contains information about the estate or trust. Ensure that all the details like the name and identification number are filled out correctly.

- Proceed to Part II if applicable, which may not require entries unless specified by the fiduciary.

- Fill out Part III, which details your share of income, deductions, credits, and other items. Pay careful attention to the boxes, such as Box 1 for interest and Box 2a for ordinary dividends, ensuring you report the correct amounts.

- If the fiduciary has specified codes in boxes 9 through 14, refer to the instructions provided and fill in any corresponding information for deductions or credits.

- Double-check your entries, especially the figures and codes in all relevant boxes, to prevent errors.

Start filing your IRS Instructions 1041 - Schedule K-1 online today!

Get form

Related links form

No, Schedule K-1 is not the same as Form 1041. Form 1041 is the tax return filed by estates and trusts, while Schedule K-1 is used to report the income that beneficiaries receive from the estate or trust. Understanding the difference is essential for accurate reporting, as noted in the IRS Instructions 1041 - Schedule K-1. This distinction helps clarify your responsibilities regarding income reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.