Loading

Get Irs Instruction W-2g & 5754 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction W-2G & 5754 online

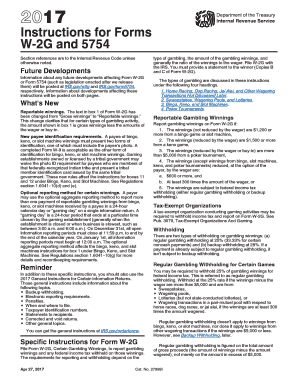

Understanding how to complete the IRS Instruction W-2G and 5754 forms online is essential for accurately reporting gambling winnings. This guide offers a clear and user-friendly approach to ensure that you navigate each section of the forms with confidence.

Follow the steps to complete your forms online effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling out Form W-2G, which includes providing the payments of $600 or more if the payment is at least 300 times the wager in box 1.

- Enter the date of the winning event in box 2. This should reflect the date of the race or game, not the payment date.

- Specify the type of wager in box 3, such as if it's a regular race bet or a different wagering method like a Daily Double.

- Input the federal income tax withheld in box 4, whether it is regular gambling withholding or backup withholding.

- If applicable, enter additional winnings from identical wagers in box 5.

- Provide the essential details of the winning transaction, including the date and identifying numbers, in boxes 6 and 7.

- For identification verification, include numbers from two forms of identification in boxes 11 and 12, ensuring they are accurate.

- Complete any state and local tax information as necessary in boxes 13 to 18, although these do not need to be submitted to the IRS.

- Once all sections are filled out thoroughly, you can save changes, download, print, or share the completed form as needed.

Start filling out your IRS forms online to ensure accurate reporting of your gambling winnings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Some post offices do carry select IRS forms, including basic tax forms. However, it’s generally more reliable to obtain IRS forms directly from the IRS website or local IRS offices for full access. For specific forms like IRS Instruction W-2G & 5754, it's best to visit the official IRS channels.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.