Loading

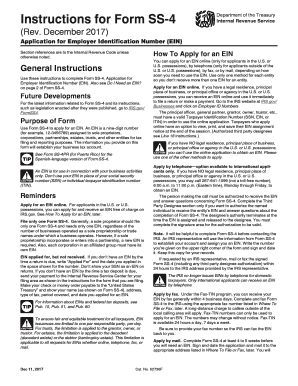

Get Irs Instruction Ss-4 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction SS-4 online

Filling out the IRS Instruction SS-4 form online is an essential step for any individual or entity seeking to obtain an Employer Identification Number (EIN). This guide aims to provide clear, step-by-step instructions to simplify the process, ensuring that you complete the form accurately and efficiently.

Follow the steps to successfully complete the IRS Instruction SS-4 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the legal name of the entity or individual applying for the EIN in line 1. Ensure that it matches exactly as it appears on the respective legal documents.

- If applicable, provide the trade name of the business on line 2, indicating the ‘doing business as’ name.

- For trusts or estates, complete line 3 with the name of the trustee or executor. Include 'care of' information, if necessary.

- Fill out the mailing address on lines 4a and 4b, ensuring accuracy for correspondence purposes.

- Provide the entity's physical address on lines 5a and 5b, if different from the mailing address.

- Select the type of entity applying for the EIN in line 9a by checking the appropriate box.

- Complete lines 6 and 7a-b with the county, state, and name of the responsible party, including their SSN or ITIN, as required.

- Identify the reason for applying on line 10 by checking the relevant box that describes your situation.

- Complete the remaining sections as applicable, ensuring all relevant fields are filled out correctly.

- Review the entire form for accuracy once all sections are filled out, then save your changes.

- Download, print, or share the form as necessary, and proceed to submit it following the IRS guidelines.

Get started and complete your IRS Instruction SS-4 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain IRS instructions, you can visit the IRS website where comprehensive guides are available, including IRS Instruction SS-4. These instructions offer the clarity needed to fill out forms correctly and navigate tax procedures. Additionally, resources from US Legal Forms may provide further support and guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.