Loading

Get Sba 1623 1988-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 1623 online

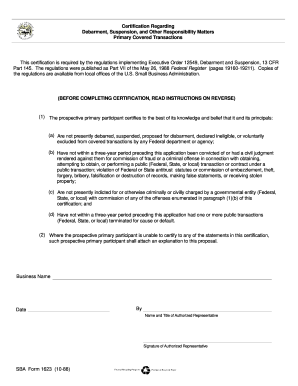

The SBA 1623 form, also known as the certification regarding debarment, suspension, and other responsibility matters, is essential for entities engaging in federal transactions. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to fill out the SBA 1623 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business name in the designated field. Ensure that the name is the legal entity's official name as registered with relevant authorities.

- Next, input the date in the provided space. Use the date format specified in the form to avoid confusion.

- In the section for the authorized representative, write the full name and title of the person who is signing the form. This role must be someone with the authority to certify the information provided.

- Proceed to sign the form where indicated. The signature must be that of the authorized representative you previously designated.

- Review the entire form to ensure all entries are accurate. Pay special attention to the certification statements. If you are unable to certify any statement, you must provide an explanation as instructed.

- Once all fields are complete and reviewed, save your changes. You can then choose to download, print, or share the form as needed.

Complete the SBA 1623 form online to ensure compliance and facilitate your participation in federal transactions.

The SBA form 1919 is primarily for those applying for SBA 7(a) loans. Individuals who own 20% or more of the business must complete this form. Additionally, any managers or partners in the business should also provide their information. If you are uncertain about this requirement, uslegalforms can help simplify the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.