Get Irs Instruction 8863 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS Instruction 8863 online

How to fill out and sign IRS Instruction 8863 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you are not linked with document management and legal procedures, completing IRS forms can be quite stressful. We fully understand the significance of accurately finishing forms. Our service offers a method to simplify the process of filling in IRS forms as much as possible. Adhere to this guide to effectively and swiftly submit IRS Instruction 8863.

How to submit the IRS Instruction 8863 online:

Utilizing our ultimate solution will enable professional completion of IRS Instruction 8863. We will take care of everything for your ease and security.

Click the button Get Form to access it and start editing.

Complete all necessary fields in your document using our advanced PDF editor. Activate the Wizard Tool to make the process even smoother.

Verify the accuracy of the entered information.

Add the completion date for IRS Instruction 8863. Utilize the Sign Tool to create your unique signature for document validation.

Conclude editing by selecting Done.

Submit this document to the IRS in the most convenient manner: via email, using online fax, or postal mail.

It is also possible to print it on paper if a copy is required and download or store it to the desired cloud storage.

How to Modify Get IRS Instruction 8863 2012: Personalize Forms Online

Select a dependable document editing tool you can trust. Update, complete, and verify Get IRS Instruction 8863 2012 safely online.

Frequently, changing documents, such as Get IRS Instruction 8863 2012, can be troublesome, particularly if you received them digitally but lack access to specific software. Naturally, you could implement some alternatives to bypass this, but you risk producing a document that won’t meet the submission criteria. Using a printer and scanner isn’t a viable solution either as it consumes both time and resources.

We offer a more straightforward and effective way to alter forms. A vast array of document templates that are easy to modify and verify, making them fillable for others. Our platform goes far beyond just a collection of templates. One of the greatest advantages of utilizing our services is that you can adjust Get IRS Instruction 8863 2012 directly on our site.

Being an online-based solution, it spares you from needing to install any software program. Moreover, not every corporate policy allows you to install it on your work computer. Here’s the simplest way to efficiently and safely finalize your forms with our service.

Forget about paper and other inefficient methods for revising your Get IRS Instruction 8863 2012 or other forms. Choose our solution instead, which combines one of the most extensive libraries of ready-to-edit templates with robust document editing services. It's simple and secure, and can save you considerable time! Don’t just believe us, try it out for yourself!

- Click the Get Form > you’ll be swiftly redirected to our editor.

- Once opened, you can initiate the modification process.

- Select checkmark or circle, line, arrow, and cross along with other choices to annotate your form.

- Pick the date option to add a specific date to your document.

- Include text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to add fillable {fields.

- Select Sign from the top toolbar to create and insert your legally binding signature.

- Press DONE to save, print, share, or obtain the result.

Get form

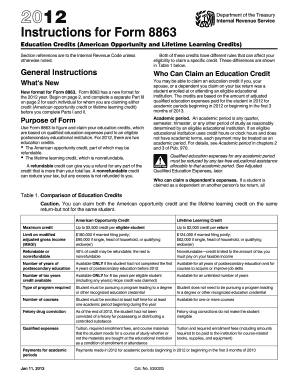

Individuals eligible to fill out IRS Instruction 8863 typically include students and parents paying for college education expenses. If you or someone you claim as a dependent is enrolled in an eligible educational institution and has incurred qualifying expenses, you should complete this form. Using tools like US Legal Forms can help you fill it out correctly and efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.