Loading

Get Irs Instruction 8283 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 8283 online

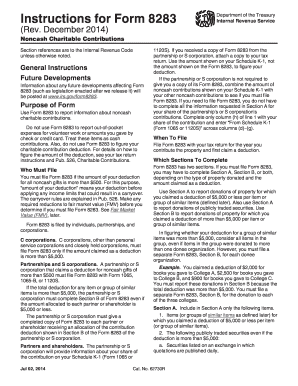

Filling out the IRS Instruction 8283 is essential for reporting noncash charitable contributions. This guide provides a clear and structured approach to help users navigate the form with ease.

Follow the steps to successfully complete the IRS Instruction 8283 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying number. If you are an individual, this would be your social security number, and for businesses, the employer identification number.

- In Section A, provide details for donated property if your claimed deduction for each item is $5,000 or less. Clearly describe each item, including the date of donation and the method of acquisition.

- For any donations valued above $5,000, complete Section B. This will also require a qualified appraisal of the property. Ensure to enter the fair market value as determined by your appraiser.

- Attach any required appraisals and supporting documentation for specific items, particularly if they fall under special rules, such as vehicles or clothing and household items in less than good condition.

- Review the information to ensure all fields are completed correctly and accurately.

- Once satisfied, users can save changes, download, print, or share the form as needed.

Complete your IRS Instruction 8283 online today to ensure accurate reporting of your charitable contributions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, the appraiser must sign form 8283 when their services are used to determine the fair market value of donated property exceeding $5,000. This requirement ensures that the value claimed on your tax return is legitimate and consistent with IRS Instruction 8283. Using platforms like US Legal Forms can help you navigate these requirements, making the process seamless and organized.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.