Get Irs Instruction 706 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 706 online

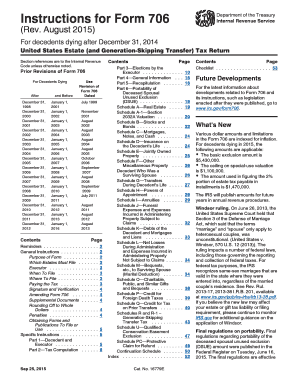

Filling out IRS Instruction 706, the United States estate (and generation-skipping transfer) tax return, can seem daunting. This guide provides a step-by-step process tailored for users of all backgrounds, ensuring that the completion of this important form is manageable and straightforward.

Follow the steps to complete IRS Instruction 706 with ease.

- Click the 'Get Form' button to open the IRS Instruction 706 in your preferred editor.

- Begin by reviewing the general instructions provided within the form. This section outlines the purpose of the form and the requirements for filing, including who must file and when to file.

- Provide details in Part 1—Decedent and Executor. Input the decedent’s details such as name, Social Security Number (SSN), and the executor's contact information.

- Move on to Part 2—Tax Computation. This section requires computation of the estate and any generation-skipping transfer taxes owed. Carefully compute the values as specified and ensure accuracy.

- Continue to Part 3—Elections by the Executor. Here, you can elect alternate valuation or special-use valuation options, if applicable.

- Fill out the various schedules (A through I) that correspond to the different types of assets included in the gross estate. Ensure that each property type is recorded accurately.

- Review and summarize in Part 5—Recapitulation by indicating totals for the assets and liabilities reported.

- Lastly, ensure you provide a signature, and save changes to complete the form. You can then download a copy, print it, or share it as necessary.

Complete your IRS Instruction 706 form online today to ensure compliance and proper estate management.

Get form

Exhibits attached to Form 706 are additional documents that provide further details about the decedent's assets, liabilities, and overall financial situation. They may include descriptions of property, valuations, and supporting evidence for deductions or credits claimed. Properly drafting these exhibits as per IRS Instruction 706 enhances the clarity and completeness of your return.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.