Loading

Get Irs Instruction 7004 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 7004 online

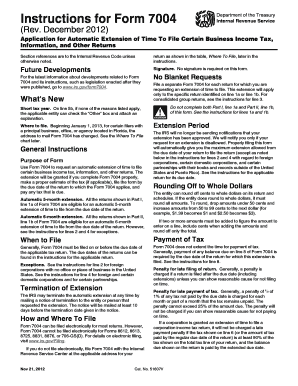

Filing for an extension of time to submit business income tax returns is simplified with IRS Form 7004. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring you meet all necessary requirements while navigating the process with ease.

Follow the steps to successfully fill out IRS Form 7004 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by accurately entering the name and identifying number of the entity requesting the extension. Ensure that this information matches the prior year's tax return to validate the extension request.

- Provide the complete address of the entity, including suite or room number if applicable. If your address has changed from the previous year, ensure the IRS is notified using appropriate forms.

- Indicate the type of extension you are requesting by selecting the appropriate form code on line 1a for a 5-month extension, or line 1b for a 6-month extension. You must choose only one of these options.

- If your entity qualifies for additional extensions due to specific circumstances (e.g., foreign corporations), check the relevant boxes and provide any required explanations or documentation directly in the fields provided.

- Estimate the total tax liability for the year as required on line 6. It is important to accurately reflect any expected credits or payments on line 7 to provide a complete picture of your tax situation.

- Lastly, ensure all provided information is accurate and complete before submitting. You can either save changes, download, print, or share the form as necessary once filled out.

Make sure to complete your documents online to ensure timely submission and avoid any late penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, any letter requesting a response or clarification requires your signature when submitting a reply. Furthermore, forms like the IRS registration may also need signatures for validation. To stay organized and ensure compliance, use tracking and organizational tools from platforms like US Legal Forms to stay on top of IRS letters and forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.