Loading

Get Irs Instruction 4797 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 4797 online

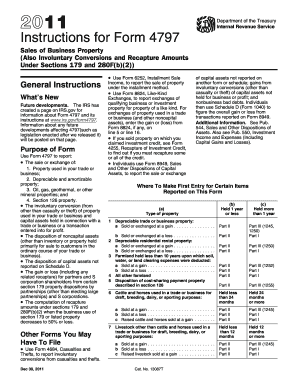

This guide provides a clear and supportive pathway for users to fill out IRS Instruction 4797 online. The form is essential for reporting the sale or exchange of business property, including involuntary conversions and recapture amounts under specific sections.

Follow the steps to complete IRS Instruction 4797 online

- Press the ‘Get Form’ button to access the IRS Instruction 4797 document online, allowing you to fill out the form electronically.

- Begin by reviewing the purpose of the form, which pertains to sales or exchanges of business property. Ensure you have all necessary information regarding the properties being reported.

- Fill in Part I for Section 1231 transactions, which includes sales of real or depreciable property used in a trade or business. Record the total gross proceeds from sales or exchanges and the corresponding basis of those properties.

- Move to Part II to report any ordinary gains or losses from transactions not included in Part I or Part III. Accurately enter all relevant figures, following the given instructions for each line.

- Proceed to Part III to calculate any gain or loss from the disposition of property. Carefully enter figures related to recapture of depreciation and any other required amounts as ordinary income.

- Review all entries for accuracy and completeness. Make any necessary adjustments to the information provided based on the current year’s transactions.

- Once all fields are filled out correctly, you can save your changes, download the completed form, print it, or share it as needed.

Start filling out your IRS Instruction 4797 online to ensure compliance and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When dealing with the sale of partnership interest, you report it on Form 4797 according to IRS Instruction 4797. You'll typically need to treat it as the sale of a capital asset. It's essential to include details about your share of the partnership's profits and losses for accurate reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.