Loading

Get Irs Instruction 4797 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 4797 online

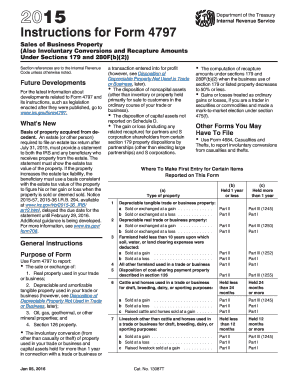

Filling out the IRS Instruction 4797 is essential for reporting the sale or exchange of business property, including involuntary conversions and recapture amounts. This guide outlines the steps necessary to complete the form accurately and efficiently in an online format.

Follow the steps to complete the IRS Instruction 4797 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out your name, address, and taxpayer identification number in the designated fields at the top of the form. These details are crucial for processing your submission.

- In Part I, report all sales or exchanges of business property used in your trade or business held for more than one year. Include amounts for real estate as well as depreciable property.

- Proceed to Part II if you have ordinary gains or losses to report. This includes transactions related to property held for one year or less. Accurately capture any relevant gains and losses in the respective sections.

- In Part III, determine any depreciation recapture. Here, you will need to calculate certain amounts, including already deducted depreciation, to report your tax correctly.

- Cross-check all entries made in the form to ensure all figures match your records and confirm accuracy. It is important to review each part carefully.

- Once all sections are completed, you can save your changes. Options such as downloading, printing, or sharing the completed form may also be available depending on the editor you are using.

Start filling out your IRS Instruction 4797 online now for a seamless submission process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To get IRS instructions for various forms, including IRS Instruction 4797, you can visit the IRS website. There, you will find comprehensive guides and instructions related to your needs. If you require more tailored assistance or templates, consider exploring UsLegalForms for more resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.