Loading

Get Irs Instruction 2441 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 2441 online

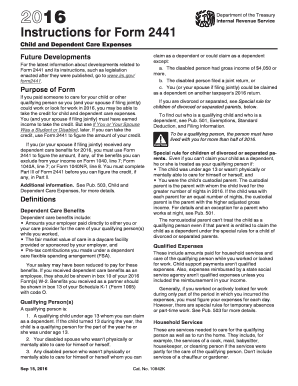

This guide provides step-by-step instructions for completing the IRS Instruction 2441 form online. Understanding how to fill out this form accurately is essential for claiming the credit for child and dependent care expenses and ensuring compliance with IRS regulations.

Follow the steps to fill out IRS Instruction 2441 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the purpose of Form 2441, which is to help you claim the credit for expenses related to child and dependent care when you worked or looked for work.

- Fill in your details at the top of the form, including your name, address, and social security number.

- Complete Part I by providing information on the qualifying person or persons, including their names and social security numbers.

- In Part II, report the total qualifying expenses incurred for care provided to the qualifying person or persons in 2016.

- Complete information about the care provider(s) in Part III, ensuring to include their name, address, and taxpayer identification numbers.

- If applicable, calculate and report any dependent care benefits received to determine the amount to exclude from your income.

- Double-check all entries for accuracy and completeness, ensuring all fields are filled in as required.

- Save any changes made to the form and prepare to download, print, or share it as necessary.

Complete your IRS Instruction 2441 form online today for a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To claim home child care on your taxes, you'll need to follow the guidelines outlined in IRS Instruction 2441. This requires you to provide details about your expenses and to fill out Form 2441 properly. You can utilize platforms like US Legal Forms for resources and assistance to ensure you capture all eligible expenses accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.