Loading

Get Ar Dfa K-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA K-1 online

Filing your Arkansas K-1 Form can be a straightforward process when you have the right guidance. This guide will walk you through each section of the AR DFA K-1, ensuring that you understand how to complete it correctly and efficiently.

Follow the steps to successfully complete the AR DFA K-1 form online.

- Click ‘Get Form’ button to obtain the AR DFA K-1 form and open it within your online editor.

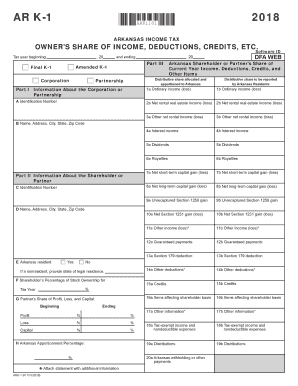

- Begin with Part I, where you will enter information about the corporation or partnership. Fill in the identification number and the name and address details as required.

- Move to Part II to complete information about the shareholder or partner. Ensure to include their identification number, name, and address. Specify whether the shareholder or partner is an Arkansas resident.

- In Part III, report the distributive share of income, deductions, and credits. Enter applicable amounts for each category outlined, such as ordinary income, rental income, dividends, and any deductions based on the partnership’s distribution.

- Review all entries in each part to ensure accuracy. Pay special attention to ensure all required fields are complete.

- Once completed, users have the option to save changes, download a copy of the form, print it, or share it as needed.

Get started with filing your documents online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain your AR DFA K-1 form, start by checking with the entity that generates it. They are required to provide the form after the end of the tax year. If you need further assistance or templates for your request, the uslegalforms platform can be a helpful resource. Ensuring you have your K-1 is vital for accurate tax filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.