Loading

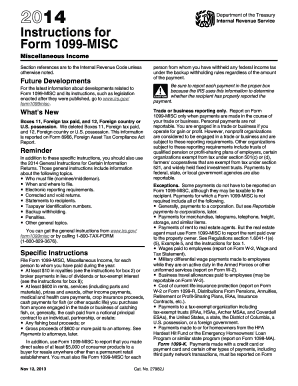

Get Irs Instruction 1099-misc 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1099-MISC online

Filling out Form 1099-MISC accurately is essential for reporting miscellaneous income to the IRS. This guide will walk you through each step of the process, ensuring you complete the form correctly and efficiently.

Follow the steps to fill out the IRS Instruction 1099-MISC online.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Provide your name, mailing address, and taxpayer identification number in the designated payer section at the top of the form.

- In box 1, report the total rents paid, if applicable. Ensure the total is at least $600 for accurate reporting.

- For royalties, enter the gross royalty payments of $10 or more in box 2. Ensure these are before any deductions.

- Input any other income that is not reported elsewhere in box 3, ensuring it totals $600 or more.

- Report any fishing boat proceeds in box 5, following the guidelines for total cash payments.

- In box 6, enter payments for medical and health care services that total at least $600.

- Document nonemployee compensation in box 7, ensuring it meets the $600 minimum requirement.

- If any federal income tax was withheld, report that amount in box 4.

- Complete the remaining boxes as applicable based on your financial transactions, ensuring accuracy and compliance.

- Once completed, save your changes, download the form, and either print or share it as necessary.

Ensure your IRS 1099-MISC is filed correctly and on time by competing your documents online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should enter a 1099-S on your tax return by including it on Schedule D and reporting any capital gains or losses. This way, the IRS accurately tracks your real estate transactions. If you have questions about its completion, consult the IRS Instruction 1099-MISC for detailed guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.