Loading

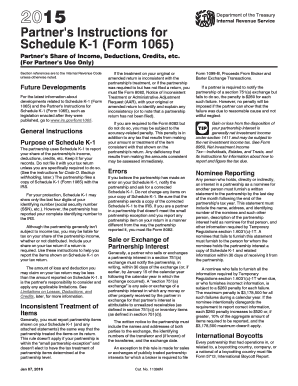

Get Irs Instruction 1065 - Schedule K-1 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

Filling out the IRS Instruction 1065 - Schedule K-1 can be a straightforward process when done online. This guide will provide you with clear, step-by-step instructions to help you accurately complete the form, ensuring that you capture all necessary information and comply with IRS requirements.

Follow the steps to complete your Schedule K-1 accurately.

- Press the ‘Get Form’ button to retrieve the form and open it in the online editor.

- Fill in Part I with information about the partnership, including the name, address, and tax identification number.

- Complete Part II by providing your details as a partner, including your name, address, and identification number.

- In Part III, report your share of the partnership's income, deductions, credits, and other items, based on the figures provided by the partnership.

- Review the amounts in boxes 1 through 20 on your Schedule K-1. Ensure you understand how to report this information on your tax return, using the instructions provided.

- Once all sections are completed accurately, save your changes in the online editor and prepare to download or print the form.

- If needed, share your completed Schedule K-1 with your tax advisor or relevant parties.

Complete your IRS Instruction 1065 - Schedule K-1 online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Absolutely, you can fill out your own IRS Instruction 1065 - Schedule K-1 if you are knowledgeable about partnership taxation. However, the complexity of some items may make it challenging. Enlisting the help of professionals or trusted platforms like uslegalforms can ensure that you complete the form correctly and avoid potential pitfalls.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.