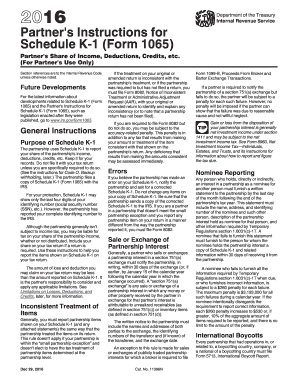

Get Irs Instruction 1065 - Schedule K-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

Filling out the IRS Instruction 1065 - Schedule K-1 online can seem daunting, but with a clear understanding of the form's components and detailed guidance, you can navigate the process with ease. This guide will walk you through each section and step required to complete the form accurately.

Follow the steps to successfully complete your Schedule K-1.

- Press ‘Get Form’ button to access the Schedule K-1 form and open it in your selected editor.

- Begin by entering the Partnership Information in Part I, including the partnership’s name, address, and Employer Identification Number (EIN) as designated in item D.

- In Part II, fill in your personal information. Ensure that the form reflects only the last four digits of your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for security.

- Complete Part III by detailing your share of the partnership's income, deductions, credits, and other items. Pay attention to the amounts shown in boxes 1 through 20, as they reflect your share and need to be accurately reported.

- Review each box for codes and instructions pertaining to your share of items, ensuring to apply any necessary limitations such as at-risk or passive activity limitations where applicable.

- If you believe there are any errors in your Schedule K-1, reach out to the partnership to request a corrected form. Do not make changes to your copy.

- Once you have completed the form and ensured accuracy, save your changes, download a copy for your records, and if necessary, print or share the form with relevant parties.

Complete your Schedule K-1 online today to ensure your tax obligations are accurately reported.

Get form

Related links form

Yes, a loss reported on a K1 can reduce your overall taxable income, subject to certain limitations. Typically, if the partnership incurs a loss, you can use that loss to offset other income, thus lowering your tax liability. For a clear understanding of how losses work in relation to IRS Instruction 1065 - Schedule K-1, our platform offers comprehensive guides and resources.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.