Loading

Get Irs Instruction 1040 Line 20a & 20b 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1040 Line 20a & 20b online

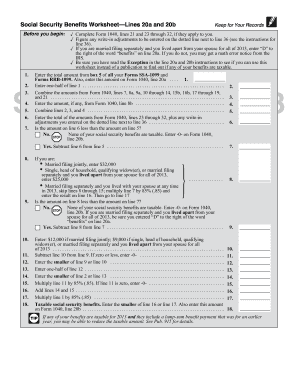

Filling out the IRS Instruction 1040 can seem daunting, especially when navigating specific lines such as 20a and 20b. This guide will provide you with clear, step-by-step instructions to help you accurately complete these sections online.

Follow the steps to successfully complete Line 20a & 20b

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Before entering any information, ensure you have completed Lines 21 and 23 through 32 of Form 1040, if they apply to you.

- If you are married filing separately and lived apart from your partner for the entire year, type 'D' to the right of the word 'benefits' on Line 20a to avoid potential math error notices from the IRS.

- Refer to the exceptions within the instructions for Lines 20a and 20b to determine if you can utilize the worksheet instead of a publication to ascertain the taxability of your benefits.

- Enter the total amount from Box 5 of all your Forms SSA-1099 and Forms RRB-1099 on Line 20a.

- On the next line, input one-half of the amount from Line 1.

- Combine amounts from Form 1040, Lines 7, 8a, 9a, 10 through 14, 15b, 16b, and 17 through 19, as well as Line 21.

- If applicable, enter the amount from Form 1040, Line 8b.

- Add the amounts you entered from Lines 2, 3, and 4 together.

- On Line 6, total the amounts from Form 1040, Lines 23 through 32, plus any write-in adjustments made on the dotted line next to Line 36.

- Check if the amount on Line 6 is less than the amount on Line 5. If it is not, enter 0 on Line 20b. If it is, continue to the next step.

- Subtract Line 6 from Line 5, and follow instructions further based on additional criteria for your filing status.

- Complete any remaining calculations as outlined in the instructions, including those pertaining to married filing jointly or separately.

- Finally, ensure that your calculations are accurate, then save any changes, download a copy, print the form, or share it as needed.

Start the process of completing your IRS forms online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Line 20 of the W-2 form represents the local wages and taxes withheld, which is crucial for local income tax calculations. Understanding this line can help you assess your overall tax obligation accurately. Referencing IRS Instruction 1040 Line 20a & 20b can also provide more insights into reporting this information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.