Get Irs Instruction 1040 - Schedule E 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1040 - Schedule E online

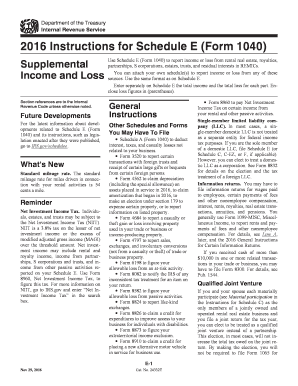

Filing your taxes accurately is essential, and Schedule E is used to report income or loss from various sources. This guide will provide you with clear and precise steps on how to fill out the IRS Instruction 1040 - Schedule E online, ensuring that you capture all necessary information correctly.

Follow the steps to fill out Schedule E efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your digital environment.

- Begin with Part I of the form, where you will report income and expenses related to rental real estate and royalties. Clearly enter the address of each rental property for lines 1a and 1b.

- On line 2, report the number of days each property was rented at fair rental value and the number of days it was used for personal purposes.

- Enter the income from rental real estate on line 3, and if applicable, enter royalty income on line 4. Make sure to attach any required additional documentation.

- In lines 5 through 21, document your rental and royalty expenses under the appropriate categories. Be diligent to exclude any personal expenses.

- Complete Part II if you have income or loss from partnerships or S corporations. Report your share accurately, using the Schedule K-1 as your guide.

- Continue to Part III for any income or loss from estates or trusts, ensuring to report as instructed.

- Upon completion, review all entries for accuracy and consistency. At the end, you can save changes to your form, download it, print, or share it.

Ensure your documents are filled out correctly by completing Schedule E online today.

Get form

Any taxpayer who has rental income or losses can file a Schedule E tax form. This includes individuals, partnerships, and S corporations. When utilizing the IRS Instruction 1040 - Schedule E, you can effectively report your income from rental properties, as well as income from partnerships or S corporations. If you need guidance on filing, USLegalForms provides excellent resources to help you through the process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.