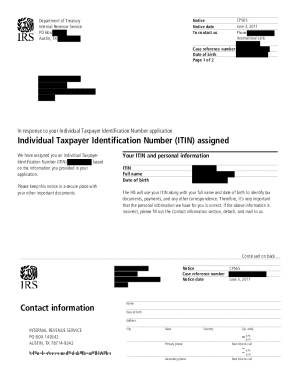

Get Irs Cp565

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS CP565 online

How to fill out and sign IRS CP565 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you aren't linked with document handling and legal protocols, completing IRS paperwork will be quite challenging. We recognize the importance of properly finalizing records. Our service offers the ideal remedy to simplify the process of submitting IRS forms as effortlessly as possible. Adhere to this instruction to swiftly and accurately fill out IRS CP565.

The method to finalize the IRS CP565 online:

Utilizing our platform will enable expert completion of IRS CP565. We will ensure everything for your convenient and effortless work.

- Press the button Get Form to access it and begin editing.

- Complete all mandatory fields in the chosen document utilizing our professional PDF editor. Activate the Wizard Tool to make the process even more straightforward.

- Verify the accuracy of the entered information.

- Include the submission date for IRS CP565. Use the Sign Tool to generate a unique signature for document validation.

- Finish editing by clicking Done.

- Deliver this document directly to the IRS in the most convenient manner: via email, using digital fax, or postal service.

- You can print it out on paper if a copy is required and download or save it to your selected cloud storage.

How to Alter IRS CP565: Tailor Forms Online

Choose a trustworthy document editing service you can depend on. Adjust, implement, and validate IRS CP565 securely online.

Frequently, altering documents, such as IRS CP565, can pose a difficulty, particularly if you obtained them online or through email but lack access to specialized software. Naturally, you can discover some alternatives to navigate this issue, but you risk producing a form that won't meet submission standards. Utilizing a printer and scanner isn't a viable solution either as it's both time- and resource-intensive.

We offer a more straightforward and effective method for completing documents. A vast collection of document templates that are easy to modify and validate, making them fillable for individuals. Our solution goes far beyond just a range of templates. One significant advantage of using our service is the ability to amend IRS CP565 directly on our platform.

Being a web-based solution, it eliminates the need for any software installation. Furthermore, not all corporate policies permit downloading it onto your work computer. Here’s how you can conveniently and securely manage your documents using our service.

Bid farewell to paper and other inefficient methods of altering your IRS CP565 or other documents. Opt for our tool that merges one of the largest libraries of customizable templates with a robust file editing feature. It’s simple and secure, and can save you considerable time! Don't just take our word for it, try it for yourself!

- Click on Get Form > you will be swiftly directed to our editor.

- Once opened, begin the customization process.

- Select checkmark, circle, line, arrow, and cross, and other options to annotate your document.

- Choose the date option to add a specific date to your form.

- Insert text boxes, images, notes, and more to enhance the content.

- Use the fillable fields option on the right to create fillable fields.

- Select Sign from the top toolbar to generate and create your legally-binding signature.

- Click DONE and save, print, and distribute or obtain the document.

Related links form

Typically, it may take several weeks to receive a CP 575 notice once requested, but times can vary based on the IRS's workload. If waiting for your CP 575 is too long, consider checking in with the IRS or using resources available through uslegalforms for guidance on expected timelines and next steps.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.