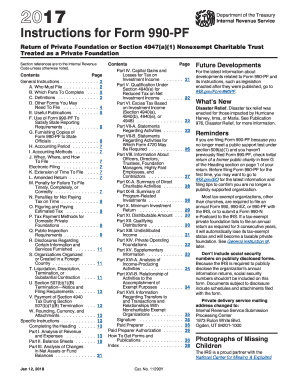

Get Irs 990-pf Instructions 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990-PF Instructions online

Filling out the IRS 990-PF is crucial for private foundations to report their financial information and comply with tax obligations. This guide provides a step-by-step approach to completing the IRS 990-PF Instructions online, ensuring clarity and support for all users, regardless of their legal experience.

Follow the steps to complete the IRS 990-PF Instructions effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the Heading section, including the legal name of the foundation, Employer Identification Number (EIN), and contact information.

- Review Section A on who must file, ensuring your foundation meets the requirements for filing the IRS 990-PF.

- Identify which parts of the return to complete based on the foundation’s activities and financial situation, as outlined in Section B.

- Fill out Part I, which includes the analysis of revenues and expenses—provide accurate figures following the guidelines.

- Complete Part II, which includes the balance sheets, and ensure all figures reflect the correct book value.

- Proceed to Part III, documenting any changes in net assets or fund balances accurately.

- For Part IV, summarize capital gains and losses incurred during the reporting period, following the specific instructions provided.

- Continue through the remaining parts, providing necessary details on all activities, investments, and any distributions made.

- At the end of the form, review all information for accuracy before saving your changes and downloading, printing, or sharing the completed form.

Begin filling out your IRS 990-PF Instructions online today to ensure compliance and effective reporting of your foundation’s activities.

Get form

Related links form

If you fail to file your Form 990-PF on time, the IRS imposes a penalty that can range from $20 to $100 per day, depending on the size of your organization. In some cases, the fine may reach up to $50,000 if you continue to neglect this obligation. Understanding the IRS 990-PF instructions can help you avoid these potential fees. US Legal Forms also offers resources to keep your filings timely and accurate.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.