Loading

Get Ar Dfa Ar1000anr 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000ANR online

Filling out the AR DFA AR1000ANR form can seem daunting, but this comprehensive guide will help you navigate each section with ease. By following the steps outlined below, you can efficiently complete your amended return for individual income tax in Arkansas.

Follow the steps to successfully complete the AR DFA AR1000ANR form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

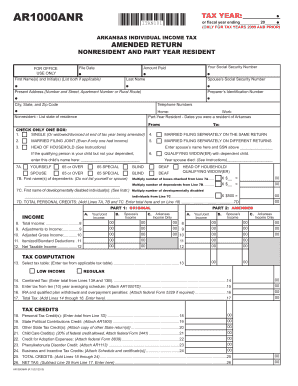

- Begin filling out the tax year information, entering the applicable year for the return and fiscal year ending if relevant for tax years 2009 and prior.

- Provide your Social Security Number along with your first name(s), initial(s), and last name. If applicable, include your spouse's Social Security Number and their details.

- Enter your present address, including apartment number or rural route, city, state, and zip code. Don't forget to provide your telephone numbers.

- Indicate whether you are a part-year resident or a nonresident. For part-year residents, fill in the dates you resided in Arkansas. Nonresidents should list their state of residence.

- Check the appropriate box to indicate your filing status: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the personal credits section by indicating the number of dependents, including any developmentally disabled individuals.

- Proceed to Part 1, where you will report your original income. List your income and your spouse's income as needed.

- In Part 2, fill out the amended tax computation. Enter your total tax and applicable deductions and credits.

- Transfer totals from previous sections to determine your net tax liability, any payments made, and potential refund or amount due.

- Sign the form at the end, including your occupation and date of signing. Your spouse should also sign if applicable.

- Once you have completed the form, save your changes, download a copy, print it, or share the form as necessary.

Complete your AR DFA AR1000ANR form online today for a seamless tax process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Arkansas, if you are filing a paper tax return such as the AR DFA AR1000ANR form, you must mail it to the appropriate address. Electronic filing is an option as well, which could save time and resources. Ensuring your return is submitted on time, whether by mail or electronically, is crucial for maintaining compliance with state law.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.