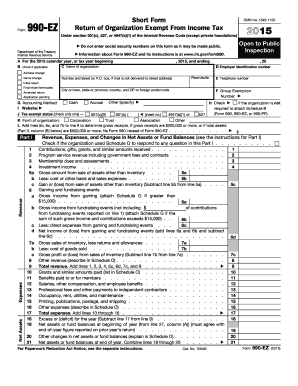

Get Irs 990-ez 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990-EZ online

How to fill out and sign IRS 990-EZ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t linked to document administration and legal procedures, completing IRS forms will be quite exhausting.

We recognize the significance of accurately finalizing documents. Our service provides the solution to make the process of handling IRS documents as simple as possible.

Utilizing our top-notch solution will turn professional completion of IRS 990-EZ into a reality. Make everything for your ease and swift work.

- Click the button Get Form to open it and start editing.

- Complete all required fields in the document using our robust and user-friendly PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the information provided.

- Include the submission date for IRS 990-EZ. Use the Sign Tool to create your customized signature for document legalization.

- Finish editing by clicking Done.

- Submit this document directly to the IRS in the most convenient manner for you: via email, using online fax, or postal service.

- You can print a hard copy if needed and download or save it to your preferred cloud storage.

How to Alter Get IRS 990-EZ 2015: personalize documents online

Experience a hassle-free and paperless method of modifying Get IRS 990-EZ 2015. Utilize our reliable online service and conserve a significant amount of time.

Creating every document, including Get IRS 990-EZ 2015, from the beginning demands too much energy, so utilizing a tested and reliable platform of pre-existing document templates can work wonders for your efficiency.

However, changing them can be challenging, particularly with files in PDF format. Fortunately, our wide-ranging catalog features a built-in editor that allows you to effortlessly complete and modify Get IRS 990-EZ 2015 without needing to leave our site, so you won’t waste hours filling out your forms. Here’s how to handle your document using our tools:

Whether you need to handle editable Get IRS 990-EZ 2015 or any other template found in our catalog, you're well on your way with our online document editor. It’s simple and secure and doesn’t require a specific tech background. Our web-based tool is crafted to manage virtually everything you can imagine regarding file editing and processing.

Forget the traditional method of handling your forms. Opt for a professional solution to assist you in optimizing your tasks and reducing reliance on paper.

- Step 1. Locate the necessary document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize professional editing functionalities that permit you to insert, remove, annotate, and emphasize or obscure text.

- Step 4. Generate and append a legally-binding signature to your document by using the sign option from the upper toolbar.

- Step 5. If the template format isn’t to your liking, use the tools on the right to delete, add, and rearrange pages.

- Step 6. Insert fillable fields so that other individuals can be invited to complete the template (if relevant).

- Step 7. Distribute or send the document, print it, or choose the format you wish to download the document in.

Get form

Related links form

IRS Form 990-EZ is a streamlined tax return specifically designed for smaller tax-exempt organizations. It provides a simpler alternative to the standard Form 990, aimed at organizations whose gross receipts are under $200,000. This form enables qualifying organizations to report financial information and maintain legal compliance with the IRS. Understanding its requirements is crucial for efficient reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.