Get Irs 990 Or 990-ez - Schedule L 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 or 990-EZ - Schedule L online

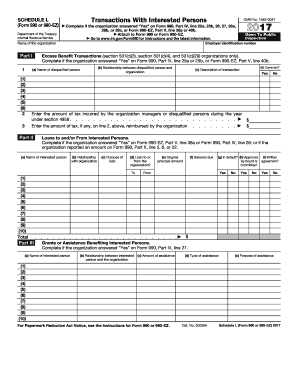

This guide provides clear and comprehensive instructions on how to complete Schedule L of the IRS 990 or 990-EZ form online. Schedule L is essential for organizations to report transactions with interested persons, ensuring transparency and compliance with IRS requirements.

Follow the steps to successfully fill out Schedule L

- Click ‘Get Form’ button to access the form and begin the process of filling it out.

- Enter the employer identification number at the top of the form. This number uniquely identifies your organization.

- In Part I, provide details of excess benefit transactions if applicable. Answer the relevant questions based on your organization's responses from Form 990 or 990-EZ.

- For each disqualified person listed, fill in their name, relationship to the organization, and a description of the transaction. Ensure to specify whether the transaction was corrected.

- In Part II, complete the section regarding loans to or from interested persons. Indicate the name, relationship, purpose of the loan, and confirm whether it is a loan to or from the organization.

- Record the original principal amount and balance due for each loan. Additionally, indicate if any loans are in default and whether they were approved by the board or committee.

- Proceed to Part III to report any grants or assistance benefiting interested persons. Ensure to clearly specify the type and purpose of the assistance provided.

- In Part IV, document any business transactions involving interested persons, outlining the amount and description of each transaction.

- Finally, use Part V for any supplemental information that may enhance understanding or clarify your responses on Schedule L.

- Once completed, save your changes, download or print the form, or share it as needed for your records.

Commence your filing of the IRS 990 or 990-EZ - Schedule L online today.

Get form

Related links form

The key distinction between IRS Form 990 and 990-EZ is their complexity and the size of the organization filing them. Form 990 requires more detailed reporting and is for larger organizations, while 990-EZ is a simplified version for smaller nonprofits. Choosing the right form helps ensure compliance and reduces filing burdens. With USLegalForms, you can quickly determine the best option for your organization.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.