Loading

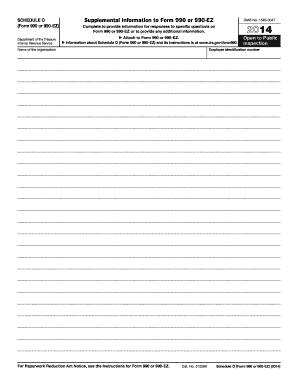

Get Irs 990 - Schedule O 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule O online

This guide provides a comprehensive overview of how to complete the IRS 990 - Schedule O online. Understanding this form is vital for organizations required to provide additional narrative information to the IRS.

Follow the steps to complete your IRS 990 - Schedule O online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Identify your organization by entering the employer identification number and the name of the organization in the specified fields.

- Review the general instructions provided on the form to understand the purpose of Schedule O and its requirements.

- Use the continuation sheets of Schedule O as necessary to provide complete responses to the specific questions on Form 990 or 990-EZ.

- Begin filling in the required information by clearly indicating the specific part and line(s) of Form 990 or 990-EZ to which each response relates.

- For each required narrative response, ensure that you provide detailed explanations regarding program services, financial statements, and governance as specified in the components of the form.

- If you are filing an amended return, mark the appropriate section and list any changed items using Schedule O.

- Before finalizing, double-check your entries for accuracy and completeness.

- Once all information is filled in, you can save changes, download, print, or share the completed form as needed.

Complete your IRS 990 - Schedule O online with confidence!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filers must submit Schedule O (Form 5471) if they are U.S. citizens or residents who control a foreign corporation. This requirement helps the IRS track operations of foreign entities and gather related data. Navigating the intricacies of IRS guidelines can be challenging, and resources like USLegalForms can help streamline the filing process by providing informative templates and support.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.