Loading

Get Irs 990 - Schedule H 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule H online

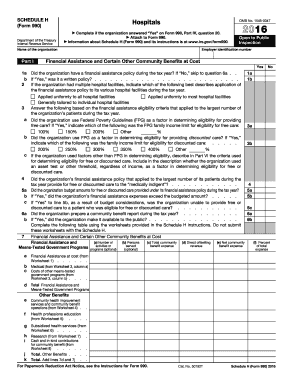

The IRS 990 - Schedule H is an essential form for hospitals that outlines financial assistance and community benefits. This guide aims to provide step-by-step instructions for accurately completing the form online.

Follow the steps to successfully complete the IRS 990 - Schedule H.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the name of the organization and its employer identification number at the top of the form.

- In Part I, answer questions regarding the financial assistance policy. If your organization had a policy, indicate if it was written and how it was applied across hospital facilities.

- Complete questions regarding eligibility criteria for free and discounted care. Specify if Federal Poverty Guidelines were utilized and what income limits determined eligibility.

- Proceed to answer questions about the financial assistance policy's budget and whether the expenses exceeded that budget. Note any impacts on service provision due to budget restrictions.

- Discuss whether a community benefit report was prepared and made publicly accessible. This shows transparency in how the organization addresses community health needs.

- Move on to Part II to detail community building activities. Report the numbers served and associated expenses for each activity your organization had.

- In Part III, address bad debt expenses and Medicare revenues. Document any discrepancies and explain the methodologies for reporting these amounts.

- Fill in information related to any management companies and joint ventures associated with the organization in Part IV.

- Complete Part V by providing facility information, including details about each hospital facility operated by the organization during the tax year.

- Finally, review all sections for accuracy, then save changes, download, print, or share the completed form as required.

Start completing your IRS 990 - Schedule H online today for a clear financial picture.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The income limit for filing Form 990 depends on the specific type of nonprofit organization. Generally, organizations with gross receipts over $50,000 must file. Smaller entities may fill out the simpler version, Form 990-EZ, while those below a certain threshold may be eligible to file Form 990-N, also known as the e-Postcard. Using uslegalforms can help clarify your organization’s filing obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.