Loading

Get Irs 990 - Schedule G 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule G online

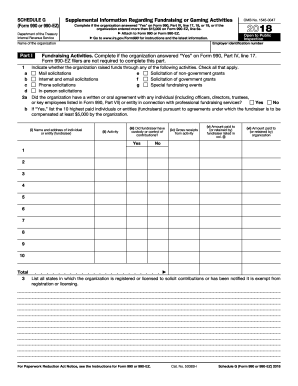

Filling out the IRS 990 - Schedule G is essential for organizations engaged in fundraising or gaming activities. This guide will provide you with clear steps to complete the form accurately online.

Follow the steps to complete the form seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the employer identification number and the name of your organization at the top of the form.

- Part I focuses on fundraising activities. Indicate which activities you engaged in by checking all that apply, such as mail solicitations, internet solicitations, and special fundraising events.

- Question 2a asks if there was a written or oral agreement with any professional fundraiser. Answer ‘Yes’ or ‘No’. If ‘Yes,’ complete all required fields for the top 10 paid fundraisers.

- In question 3, list all states where your organization is registered to solicit contributions or is exempt from registration.

- Proceed to Part II, which covers direct expenses and revenue. List your gross receipts and contributions to calculate your gross income.

- Detail the expenses associated with fundraising, including cash and noncash prizes, venue costs, food, and other direct expenses. Ensure totals are accurately calculated.

- Part III focuses on fundraising events. List any events where gross receipts exceeded $5,000 and summarize the direct expenses to determine net income.

- If applicable, fill out the gaming section, indicating revenue and expenses related to gaming activities, licenses, and distributions.

- Finally, provide any required supplemental information as outlined in Part IV, offering explanations for any relevant inquiries.

- After you have filled out the form, you can save the changes, download, print, or share the completed form.

Complete your IRS 990 - Schedule G online today for compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A Schedule G tax return refers to the section of IRS Form 990 dedicated to reporting fundraising activities. It allows tax-exempt organizations to list and explain the fundraising methods they use. Filing this schedule accurately helps organizations maintain compliance with IRS regulations and enhances transparency.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.