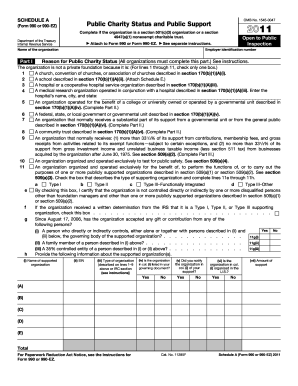

Get Irs 990 - Schedule A 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 - Schedule A online

How to fill out and sign IRS 990 - Schedule A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document management and legal procedures, submitting IRS paperwork appears challenging.

We acknowledge the importance of accurately finalizing documents.

Using our service will enable professional completion of IRS 990 - Schedule A. We will ensure everything is set up for your ease and simplicity.

- Click on the button Get Form to access it and begin making changes.

- Complete all required fields in the chosen document using our professional PDF editor. Activate the Wizard Tool to simplify the process even further.

- Verify the accuracy of the entered information.

- Add the date of submitting IRS 990 - Schedule A. Utilize the Sign Tool to generate your signature for document validation.

- Finish editing by clicking Done.

- Send this document directly to the IRS in the most convenient method for you: via e-mail, using digital fax, or postal service.

- You can print it on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 990 - Schedule A 2011: personalize forms online

Locate the right Get IRS 990 - Schedule A 2011 template and adjust it immediately. Streamline your documentation with an intelligent document editing tool for online forms.

Your daily tasks with documents and forms can be more efficient when you have all you require in a single location. For instance, you can search, obtain, and modify Get IRS 990 - Schedule A 2011 within one browser tab. If you need a specific Get IRS 990 - Schedule A 2011, you can swiftly locate it using the smart search engine and access it right away. There’s no need to download it or look for a third-party editor to alter it and include your information. All the resources for effective work are in one consolidated solution.

This editing solution allows you to personalize, complete, and sign your Get IRS 990 - Schedule A 2011 form instantly. When you find a suitable template, click on it to enter the editing mode. Once you access the form in the editor, you will have all the necessary tools at your disposal. It’s simple to fill in the designated fields and remove them if needed using a straightforward yet versatile toolbar. Implement all changes immediately, and sign the form without leaving the tab simply by clicking the signature field. After that, you can send or print your document if required.

Make additional custom alterations with the available tools.

Uncover new opportunities for streamlined and straightforward documentation. Find the Get IRS 990 - Schedule A 2011 you need in moments and complete it within the same tab. Eliminate the clutter in your paperwork for good with the assistance of online forms.

- Annotate your document with the Sticky note feature by placing notes anywhere in the document.

- Incorporate necessary visual elements, if required, using the Circle, Check, or Cross tools.

- Alter or insert text anywhere in the document with the Texts and Text box tools. Add information with the Initials or Date feature.

- Change the template text with the Highlight and Blackout, or Erase tools.

- Insert custom visual aids with the Arrow and Line, or Draw tools.

Get form

When filing your IRS 990 - Schedule A, you can mail it to the address specified by the IRS based on your organization's location and size. Generally, smaller organizations can send their forms to the IRS processing center in Ogden, Utah. It's essential to verify the appropriate mailing address and any specific instructions that apply to your form.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.