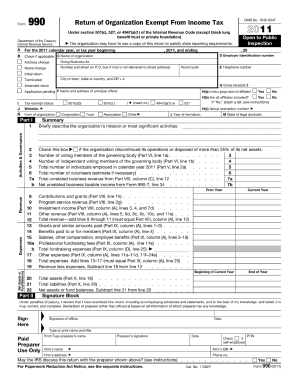

Get Irs 990 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 online

How to fill out and sign IRS 990 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document management and legal procedures, submitting IRS paperwork can be quite stressful.

We understand the importance of accurately completing documents.

Utilizing our online software can certainly turn expert filling of IRS 990 into a reality. Make everything for your convenient and effortless work.

- Click on the button Get Form to access it and begin editing.

- Fill in all necessary fields in the document using our beneficial PDF editor. Activate the Wizard Tool to make the process even simpler.

- Ensure the accuracy of the information provided.

- Include the completion date of the IRS 990. Use the Sign Tool to create your unique signature for document validation.

- Finalize editing by clicking Done.

- Send this document directly to the IRS in the most suitable manner for you: via email, using digital fax, or postal service.

- You can print it on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to Alter Get IRS 990 2011: Customize Forms Online

Filling out documents is straightforward with intelligent online tools. Eliminate paperwork with easily accessible Get IRS 990 2011 forms that you can adjust online and print.

Drafting documents and forms should be more convenient, whether it's a routine aspect of someone's job or infrequent tasks. When an individual needs to submit a Get IRS 990 2011, learning about laws and guides on how to accurately complete a form and what it should incorporate can demand a significant amount of time and effort. Nonetheless, if you discover the appropriate Get IRS 990 2011 format, completing a document will no longer be a difficulty with an intelligent editor available.

Uncover a broader assortment of capabilities to integrate into your document processing routine. There’s no need to print, fill out, and annotate forms by hand. With a smart editing platform, all the crucial document processing functionalities will consistently be at your disposal. If you aim to enhance your workflow with Get IRS 990 2011 forms, locate the template in the library, choose it, and discover a more straightforward method to complete it.

Simplifying the likelihood of mistakes using the Initials and Date tools is also achievable. Additionally, it is simple to append custom visual features to the document. Utilize the Arrow, Line, and Draw tools to customize the form. The more tools you are adept with, the easier it becomes to handle Get IRS 990 2011. Explore the solution that furnishes everything necessary to find and modify forms in a single tab of your browser and put an end to manual paperwork.

- If you wish to incorporate text in a random area of the document or add a text field, utilize the Text and Text Field tools and enlarge the text in the document as needed.

- Utilize the Highlight tool to emphasize the significant sections of the form.

- In case you want to obscure or eliminate specific text portions, employ the Blackout or Erase tools.

- Personalize the form by integrating default graphic elements into it. Use the Circle, Check, and Cross tools to add these elements to the forms, if necessary.

- If extra annotations are needed, use the Sticky Note feature and place as many notes on the forms page as you require.

- If the form mandates your initials or date, the editor provides tools for that as well.

Get form

Whether your nonprofit needs to file an IRS Form 990 depends on its financial status and structure. Generally, organizations with gross receipts over $50,000 must submit this return annually. If you're uncertain about your requirements, it’s wise to consult legal or accounting professionals for advice tailored to your specific situation. Tools from US Legal Forms can simplify this process for you.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.