Loading

Get 944 2011 Form 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 944 2011 form online

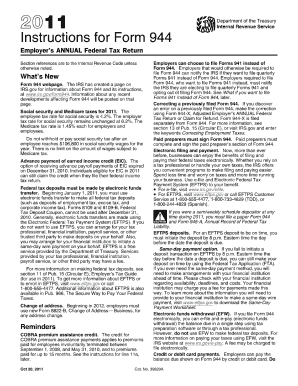

Filling out the 944 2011 form online can seem daunting, but this guide provides clear and supportive instructions to help users navigate the process with ease. This form is specifically designed for employers with a low employment tax liability, allowing them to report annual federal tax returns simply and effectively.

Follow the steps to successfully complete the 944 2011 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN), name, and address in the spaces provided on the form. Ensure that the information matches the records with the IRS.

- Report all wages, tips, and other forms of compensation paid to employees during the year in the appropriate sections. Include amounts that would also appear in box 1 of your employees' W-2 forms.

- Indicate the federal income tax withheld from wages on the designated line. Be precise and accurate to avoid future penalties.

- Fill in details pertaining to social security and Medicare taxes based on wages paid. Ensure to include tips reported by employees and account for any adjustments.

- If applicable, report any additional Medicare tax withheld from wages exceeding $200,000 per individual during the year.

- Complete any current year’s adjustments as necessary, including those for sick pay or group-term life insurance.

- Reconcile the total liabilities on your form, adding any taxes before adjustments and accounting for the total deposits made throughout the year.

- Review all sections to ensure accuracy and completeness, then proceed to electronically sign the Docusign if required.

- Upon final review, save your changes, and choose the option to download, print, or share the completed form as necessary.

Start filling out the 944 2011 form online today to streamline your tax reporting process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To determine whether to use the 941 or 944 forms, assess your expected employment tax liability for the year. If it is $1000 or less, you may qualify for the 944 2011 Form. Make sure to review your payroll details and consult the IRS guidelines to make the best choice for your business needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.