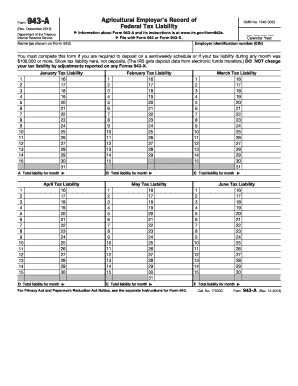

Get Irs 943-a 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 943-A online

How to fill out and sign IRS 943-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document management and legal procedures, completing IRS forms can be incredibly stressful.

We understand the importance of accurately filling out forms.

Utilizing our comprehensive solution will enable professional completion of IRS 943-A, ensuring your work is comfortable and efficient.

- Click the button Get Form to access it and start editing.

- Complete all necessary fields in the document using our efficient and easy-to-use PDF editor. Activate the Wizard Tool to make the process even easier.

- Ensure the accuracy of the entered information.

- Include the date for submitting IRS 943-A. Use the Sign Tool to create a personalized signature for document authentication.

- Finish editing by clicking Done.

- Submit this document to the IRS in the manner that is most convenient for you: via email, by digital fax, or through the mail.

- You can print it on paper if a hard copy is required and download or save it to your preferred cloud storage.

How to amend Get IRS 943-A 2013: personalize forms online

Experience a hassle-free and paperless method of altering Get IRS 943-A 2013. Utilize our reliable online service and save a significant amount of time.

Creating every document, including Get IRS 943-A 2013, from scratch consumes too much energy, therefore having a tested and reliable platform of pre-uploaded form templates can significantly enhance your efficiency.

However, altering them can be challenging, particularly when dealing with PDF documents. Luckily, our extensive database includes a built-in editor that enables you to swiftly finalize and tailor Get IRS 943-A 2013 without exiting our site, ensuring you do not squander time filling out your forms. Here’s how to use our service with your file:

Whether you need to produce editable Get IRS 943-A 2013 or any other form in our inventory, you are well prepared with our online document editor. It's straightforward and secure and does not require any special expertise. Our web-based solution is crafted to manage almost everything you can think of in regard to document editing and completion.

No longer utilize outdated methods of handling your documents. Opt for a professional solution to assist you in streamlining your tasks and making them less reliant on paper.

- Step 1. Find the required form on our site.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Utilize specialized editing tools that allow you to insert, delete, annotate, and highlight or obscure text.

- Step 4. Create and attach a legally-binding signature to your document by using the sign option from the top toolbar.

- Step 5. If the form layout doesn’t appear as you wish, use the tools on the right to delete, add, and rearrange pages.

- Step 6. Insert fillable fields so others can be invited to complete the form (if needed).

- Step 7. Distribute or send the document, print it, or choose the format in which you would like to receive the document.

Get form

IRS Form 943A is required for employers who are required to file Form 943 and need to report their tax liabilities. This typically applies to those who employ agricultural workers and have an annual payroll that warrants this filing. Knowing your requirements helps ensure compliance and avoids penalties. For comprehensive support, consider uslegalforms as your resource.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.