Loading

Get Irs 943 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 943 online

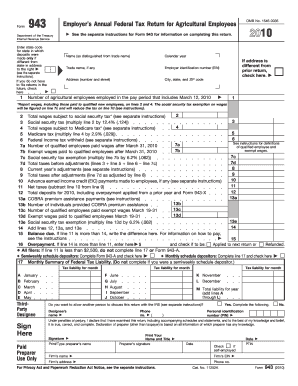

Filing the IRS 943 form, also known as the Employer’s Annual Federal Tax Return for Agricultural Employees, is essential for agricultural employers. This guide provides step-by-step instructions for filling out the form online, ensuring clarity and ease of understanding.

Follow the steps to complete the IRS 943 form online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) in the designated box, which is crucial for tax processing.

- Provide your name, trade name (if applicable), and address details. Ensure that the information matches your previous filings, if relevant.

- Indicate the number of agricultural employees you had during the pay period that includes March 12, ensuring accuracy for tax calculations.

- Fill in the total wages subject to social security tax and calculate the corresponding tax owed by applying the specified percentage.

- Report the total wages subject to Medicare tax and compute the tax accordingly.

- Include any federal income tax withheld and specify the necessary details for qualified employees and any exemptions.

- Summarize the calculated taxes, including any adjustments and credits, to determine the net taxes owed.

- If applicable, complete the section for COBRA premium assistance payments, providing necessary counts and amounts.

- Review all entries for accuracy. Once all fields are completed, save changes, and you may choose to download, print, or share the completed form.

Complete your IRS 943 form online today to stay compliant with tax regulations and simplify your filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, reporting the sale of land to the IRS is necessary. Any significant sales, including land, typically trigger capital gains taxes. You should include this income in your tax filings, which may require form submissions related to IRS 943 if you're involved in agricultural enterprises. Stay informed to handle these regulations correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.