Loading

Get Ar Ar-20 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR-20 online

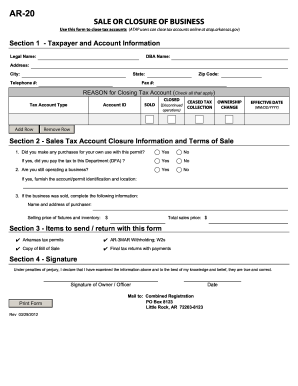

The AR AR-20 form is essential for individuals or businesses looking to close their tax accounts in Arkansas. This guide will provide a clear, step-by-step process to help you complete the form accurately and efficiently.

Follow the steps to fill out the AR AR-20 form with ease.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Section 1, input your legal name, DBA (doing business as) name, and your complete address including city, state, telephone number, and zip code. If applicable, provide your fax number.

- Select the reason for closing your tax account by checking all boxes that apply, such as sold, discontinued operations, ceased tax collection, or ownership change.

- Enter the effective date for the closure in the format MM/DD/YYYY.

- In Section 2, answer whether you made any purchases for your own use with this permit and indicate if you paid the tax to the Department of Finance and Administration (DFA). Also, specify if you are still operating the business by selecting yes or no.

- If the business has been sold, provide the name and address of the purchaser along with the selling price of fixtures and inventory and the total sales price.

- In Section 3, prepare to send or return required items with your form, including Arkansas tax permits, AR-3MAR withholding forms and W-2s, a copy of the bill of sale, and final tax returns with payments.

- In Section 4, sign the form and print your name. By signing, you declare that the information provided is true and correct under penalties of perjury.

- Save any changes you have made to the form. You can then download, print, or share the completed form as necessary.

Start completing your AR AR-20 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you encounter difficulties e-filing your Arkansas state taxes, it may be due to several reasons such as unresolved issues with your personal details or software compatibility. Ensure you meet all eligibility criteria, as certain forms may not be available for e-filing. Consider checking USLegalForms for assistance in navigating the requirements for submitting your AR AR-20 electronically.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.