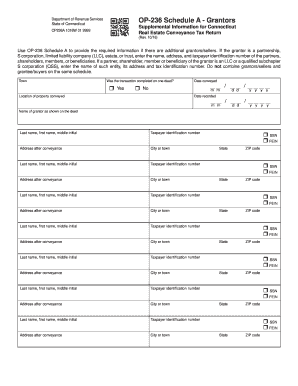

Get Ct Op-236 Schedule A 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT OP-236 Schedule A online

How to fill out and sign CT OP-236 Schedule A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period commenced unexpectedly or perhaps you simply overlooked it, it might potentially lead to issues for you.

CT OP-236 Schedule A is not the easiest form, but you do not need to be alarmed in any situation.

Utilizing our robust digital solution and its practical tools, completing CT OP-236 Schedule A becomes simpler. Do not hesitate to engage with it and enjoy more time on activities rather than on document preparation.

- Access the document using our specialized PDF editor.

- Complete the required information in CT OP-236 Schedule A, using the fillable fields.

- Add images, marks, ticks, and text boxes, if desired.

- Repeating fields will be automatically included after the initial entry.

- If you encounter challenges, activate the Wizard Tool. You will receive guidance for smoother submission.

- Always remember to add the filing date.

- Create your distinct e-signature once and place it on the necessary lines.

- Review the information you have provided. Amend errors if necessary.

- Press Done to finalize edits and select your submission method. You can use online fax, USPS, or email.

- You can download the file to print later or upload it to cloud storage like Google Drive, OneDrive, etc.

How to Modify Get CT OP-236 Schedule A 2016: Customize Forms Online

Filling out documents is straightforward with intelligent web-based tools.

Remove paper-based tasks with easily accessible Get CT OP-236 Schedule A 2016 templates you can alter online and print.

Creating documents and forms should be more attainable, whether a common part of one's career or occasional activity. When an individual needs to submit a Get CT OP-236 Schedule A 2016, understanding rules and instructions on how to accurately fill out a form and its necessary contents can consume significant time and effort. However, if you locate the right Get CT OP-236 Schedule A 2016 template, completing a document will no longer be a difficulty with an intelligent editor available.

Utilize the Highlight feature to emphasize the key parts of the form. If you need to obscure or delete certain text segments, employ the Blackout or Erase tools.

- Explore a wider array of functionalities you can incorporate into your document processing routine.

- No longer necessary to print, fill out, and mark forms by hand.

- With a clever editing software, all vital document management options will always be accessible.

- If you aim to enhance your workflow with Get CT OP-236 Schedule A 2016 forms, find the template in the directory, choose it, and uncover an easier method to complete it.

- If you wish to insert text in a specific section of the form or integrate a text field, utilize the Text and Text field features and expand the text in the form as needed.

Related links form

Corporations operating within Connecticut that earn income must file Form CT-1120. This requirement applies to both domestic and foreign corporations conducting business in the state. It is vital for these corporations to also assess potential capital gains impacts using the CT OP-236 Schedule A as part of their overall filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.