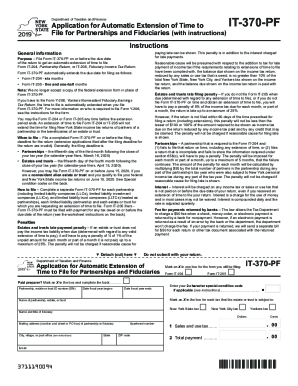

Get Ny Dtf It-370-pf 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-370-PF online

How to fill out and sign NY DTF IT-370-PF online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

These days, most Americans tend to prefer to do their own taxes and, in addition, to fill out forms digitally. The US Legal Forms browser service makes the process of submitting the NY DTF IT-370-PF easy and convenient. Now it takes not more than half an hour, and you can do it from any place.

Tips on how to finish NY DTF IT-370-PF quick and easy:

-

Access the PDF template in the editor.

-

See the outlined fillable lines. This is where to insert your information.

-

Click the option to select if you see the checkboxes.

-

Check out the Text icon and also other powerful features to manually modify the NY DTF IT-370-PF.

-

Confirm every piece of information before you resume signing.

-

Create your distinctive eSignature using a key pad, digital camera, touchpad, mouse or cellphone.

-

Certify your template electronically and place the particular date.

-

Click on Done proceed.

-

Save or deliver the record to the receiver.

Ensure that you have completed and sent the NY DTF IT-370-PF correctly by the due date. Think about any deadline. If you provide incorrect info with your fiscal reports, it may result in severe fines and cause problems with your yearly tax return. Be sure to use only professional templates with US Legal Forms!

How to edit NY DTF IT-370-PF: customize forms online

Use our advanced editor to transform a simple online template into a completed document. Keep reading to learn how to edit NY DTF IT-370-PF online easily.

Once you discover a perfect NY DTF IT-370-PF, all you need to do is adjust the template to your needs or legal requirements. Apart from completing the fillable form with accurate details, you may need to erase some provisions in the document that are irrelevant to your circumstance. Alternatively, you might want to add some missing conditions in the original form. Our advanced document editing tools are the simplest way to fix and adjust the document.

The editor enables you to change the content of any form, even if the document is in PDF format. It is possible to add and remove text, insert fillable fields, and make extra changes while keeping the initial formatting of the document. You can also rearrange the structure of the form by changing page order.

You don’t have to print the NY DTF IT-370-PF to sign it. The editor comes along with electronic signature capabilities. Most of the forms already have signature fields. So, you simply need to add your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to create your NY DTF IT-370-PF:

- Open the preferred form.

- Use the toolbar to adjust the form to your preferences.

- Fill out the form providing accurate details.

- Click on the signature field and add your eSignature.

- Send the document for signature to other signers if needed.

Once all parties complete the document, you will get a signed copy which you can download, print, and share with others.

Our services enable you to save tons of your time and minimize the chance of an error in your documents. Enhance your document workflows with effective editing capabilities and a powerful eSignature solution.

Get form

Related links form

If you don't file a Federal consolidated return and you owe Tennessee tax, you can request a state extension using either Tennessee Form FAE-173 or Federal Form 7004. Tennessee Extension Payment Requirement: An extension of time to file is not an extension of time to pay.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.