Loading

Get Ak 0405-021i 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 0405-021i online

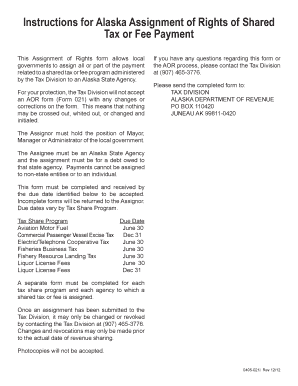

The AK 0405-021i form is essential for local governments in Alaska to assign payment rights related to shared tax or fee programs to a state agency. Filling out this form accurately and completely is crucial to ensure acceptance by the Tax Division.

Follow the steps to complete the AK 0405-021i form online.

- Click the ‘Get Form’ button to access the AK 0405-021i form and open it in your editor.

- Identify the Assignor section, where you will need to enter the name and title of the local government official who is authorized to make this assignment, such as the Mayor, Manager, or Administrator.

- Fill out the Assignee section with the name of the Alaska State Agency that will receive the assigned payment. Ensure this agency is related to the debt owed.

- Specify the shared tax or fee program in the designated section. Note that each program requires a separate form.

- Clearly indicate the payment amount that is being assigned to the state agency.

- Review all provided information for accuracy. Remember that no changes, corrections, or initialing are allowed on the form.

- Complete any required additional fields, such as contact information for the Assignor or specific instructions for the Assignee.

- Once you are confident that all sections are complete and accurate, save your changes. You can then choose to download, print, or share the form as needed.

Complete your documents online today to ensure timely processing.

Related links form

Filing an amended Schedule K-1 involves receiving the corrected K-1 form from the entity that issued it. You will then update your records and use the information to complete an amended return, such as the AK 0405-021i, where necessary. Ensure you keep all documentation for your records to support the changes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.