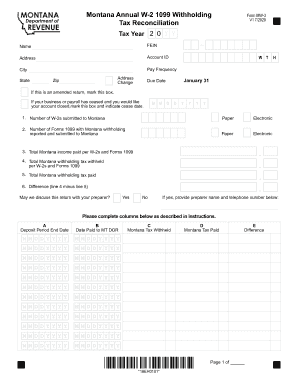

Get Mt Dor Mw-3 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MT DoR MW-3 online

How to fill out and sign MT DoR MW-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Today, most Americans tend to prefer to do their own income taxes and, in fact, to complete reports electronically. The US Legal Forms browser platform makes the procedure of preparing the MT DoR MW-3 simple and handy. Now it requires not more than 30 minutes, and you can accomplish it from any location.

Tips on how to fill up MT DoR MW-3 easy and fast:

-

Open the PDF blank in the editor.

-

See the highlighted fillable lines. Here you can insert your details.

-

Click the variant to select if you see the checkboxes.

-

Check out the Text icon along with other powerful features to manually modify the MT DoR MW-3.

-

Inspect all the details before you continue to sign.

-

Make your unique eSignature by using a key-board, digital camera, touchpad, mouse or mobile phone.

-

Certify your web-template electronically and indicate the date.

-

Click Done proceed.

-

Download or send out the document to the receiver.

Be sure that you have filled in and sent the MT DoR MW-3 correctly in time. Take into account any applicable term. When you provide inaccurate data with your fiscal reports, it can result in serious fees and cause problems with your yearly tax return. Use only professional templates with US Legal Forms!

How to edit MT DoR MW-3: customize forms online

Have your stressless and paper-free way of working with MT DoR MW-3. Use our trusted online option and save tons of time.

Drafting every form, including MT DoR MW-3, from scratch requires too much time, so having a tried-and-true platform of pre-uploaded document templates can do wonders for your efficiency.

But working with them can be struggle, especially when it comes to the files in PDF format. Fortunately, our extensive library includes a built-in editor that lets you easily complete and customize MT DoR MW-3 without the need of leaving our website so that you don't need to waste your precious completing your paperwork. Here's what to do with your document utilizing our tools:

- Step 1. Locate the required document on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Use our professional editing tools that allow you to add, remove, annotate and highlight or blackout text.

- Step 4. Generate and add a legally-binding signature to your document by using the sign option from the top toolbar.

- Step 5. If the template layout doesn’t look the way you want it, utilize the tools on the right to erase, put, and re-order pages.

- step 6. Insert fillable fields so other persons can be invited to complete the template (if applicable).

- Step 7. Share or send the form, print it out, or select the format in which you’d like to download the document.

Whether you need to complete editable MT DoR MW-3 or any other template available in our catalog, you’re on the right track with our online document editor. It's easy and secure and doesn’t require you to have particular tech background. Our web-based tool is set up to handle practical everything you can think of when it comes to document editing and execution.

No longer use conventional way of handling your documents. Choose a a professional option to help you simplify your activities and make them less reliant on paper.

Get form

Form 1042-S is used to report amounts paid to foreign persons that are subject to income tax withholding, even if no amount is deducted and withheld from the payment because of a treaty or exception to taxation, or if any amount withheld was repaid to the payee.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.