Loading

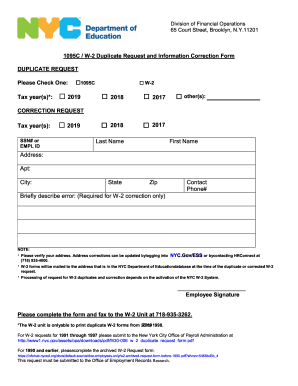

Get Ny 1095c/w-2 Duplicate Request And Information Correction Form 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY 1095C/W-2 Duplicate Request And Information Correction Form online

This guide provides you with step-by-step instructions for completing the NY 1095C/W-2 Duplicate Request And Information Correction Form online. Whether you are requesting a duplicate or correcting information, this comprehensive guide will help ensure you fill out the form accurately.

Follow the steps to complete your form efficiently.

- Click the ‘Get Form’ button to access the NY 1095C/W-2 Duplicate Request And Information Correction Form and open it in an online editor.

- Indicate whether you are making a duplicate request or a correction request by checking the appropriate option. Select the tax year(s) relevant to your request by marking the corresponding checkbox.

- For the correction request, provide your Social Security Number (SSN) or Employee ID in the specified field. Fill in your last name, first name, and contact information including your address, apartment number if applicable, city, state, and zip code.

- If you are requesting a W-2 correction, briefly describe the error in the dedicated section. This information is required for your request to be processed.

- Review all entered information for accuracy, especially your address. Keep in mind that W-2 forms will be sent to the address registered in the NYC Department of Education database.

- After ensuring that all information is correct, complete the Employee Signature section and get ready to submit the form.

- Once completed, save your changes, and then fax the form to the W-2 Unit at 718-935-3262 for processing.

Complete your 1095C/W-2 Duplicate Request And Information Correction Form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is a document your employer may have sent you this tax season (or will be sending you soon) in addition to your W-2 wage form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.