Loading

Get Mi Mi-1040d 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1040D online

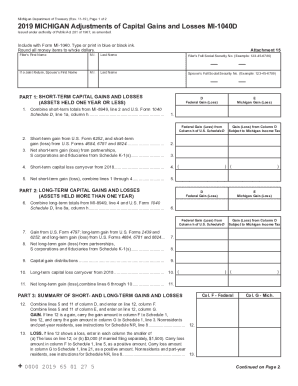

The MI MI-1040D form is used for adjusting capital gains and losses in Michigan. This guide provides clear and detailed steps on how to fill out the form online, making the process simpler for all users.

Follow the steps to complete the MI MI-1040D online.

- Press the ‘Get Form’ button to access the MI MI-1040D form and open it in your chosen online editor.

- Enter your details in the filer’s section: provide your first name, middle initial, last name, and full Social Security number. If filing jointly, include your spouse’s details similarly.

- Proceed to Part 1 for short-term capital gains and losses. Start by combining totals from MI-8949, line 2, and U.S. Form 1040 Schedule D, line 1a, column h. Enter these values into the designated fields.

- Continue filling out lines 2 to 4 in Part 1, ensuring that you accurately report short-term gains or losses from U.S. forms as outlined.

- Move to Part 2 for long-term capital gains and losses. Begin by combining totals from MI-8949, line 4, and U.S. Form 1040 Schedule D, line 8a, column h. Fill this in the appropriate field.

- Fill out lines 7 to 10 in Part 2 following the same procedure for reporting gains or losses from relevant forms.

- In Part 3, summarize short- and long-term gains and losses. Complete line 12 by entering the combined results from columns D and E.

- For any gains reported on line 12, follow the instructions to carry the amounts to Schedule 1 as applicable.

- If there is a loss on line 12, complete line 13 as instructed, calculating the appropriate amounts to carry to Schedule 1.

- Proceed to Part 4 to compute capital loss carryovers for the next year. Follow the steps for lines 14 to 29, entering figures accordingly and ensuring all calculations are accurate.

- Finally, review all entries for accuracy, then save your changes, download, print, or share the completed form as required.

Get started on completing your MI MI-1040D online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If your state of residence is Michigan and you are mailing a federal tax return/Form 1040 without a payment, you will mail it to Department of the Treasury Internal Revenue Service Fresno, CA 93888-0002.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.