Get Ca Form 3548 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3548 online

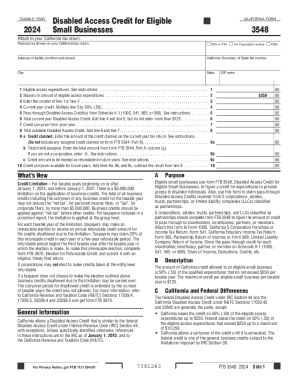

Filling out the California Form 3548 is a key step for eligible small businesses seeking to claim the Disabled Access Credit. This guide provides a structured approach to ensure you understand each section of the form and can complete it accurately online.

Follow the steps to fill out the CA Form 3548 with clarity and confidence.

- Press the ‘Get Form’ button to access the CA Form 3548. Ensure that you have a stable internet connection and a web browser that supports online form completion.

- Enter your name(s) as shown on your California tax return in the designated field. This information is essential to accurately link your submission with your tax records.

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), California Corporation number, or Federal Employer Identification Number (FEIN) as applicable.

- Fill in the address of your facility, including the number and street, city, state, and ZIP code, to identify the location related to the claim.

- Input the total eligible access expenditures in Line 1. This figure should be based on actual expenses incurred during the current taxable year related to making your business accessible.

- On Line 2, state the maximum amount of eligible access expenditures, which should align with the amount indicated in the instructions.

- In Line 3, enter the smaller value of Line 1 or Line 2 to determine the qualified amount eligible for credit.

- Multiply the amount from Line 3 by 50% and enter it on Line 4 to calculate the current year credit.

- If applicable, include any pass-through Disabled Access Credits received from S corporations, estates, trusts, partnerships, or LLCs in Line 5.

- Add the amounts from Line 4 and Line 5 to determine the total current year Disabled Access Credit, entering the result on Line 6.

- If you have any credit carryover from the previous year, enter it on Line 7.

- Calculate the total available Disabled Access Credit by adding Lines 6 and 7, entering this total on Line 8.

- On Lines 9a, 9b, and 9c, enter the respective values related to credit claimed and total credit assigned, following directions based on your specific circumstances.

- Finally, on Line 10, compute and note the credit carryover available for future years, ensuring it is accurate as it will affect your future tax liabilities.

- Review all your entries for accuracy. Once all fields are completed and verified, you can save your changes, as needed, download the form, print it, or share it online.

Complete your CA Form 3548 online today to take advantage of the Disabled Access Credit and improve accessibility for everyone.

To submit Form 15CA online, you should visit the official California Franchise Tax Board website. They provide a step-by-step guide on how to upload your form electronically. This online submission is convenient and helps expedite your filing process, especially when you're also preparing documents such as CA Form 3548. If you encounter difficulties, platforms like uslegalforms can offer assistance and resources to help you through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.