Get Ky 51a111 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KY 51A111 online

How to fill out and sign KY 51A111 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

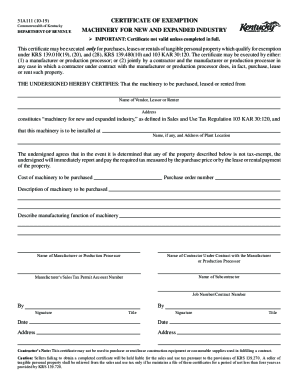

Registering your revenue and submitting all the vital tax papers, including KY 51A111, is a US citizen?s sole obligation. US Legal Forms tends to make your tax control more accessible and efficient. You will find any lawful forms you need and fill out them digitally.

How you can complete KY 51A111 on the internet:

-

Get KY 51A111 within your browser from your device.

-

Gain access to the fillable PDF document with a click.

-

Begin completing the template box by box, using the prompts of the sophisticated PDF editor?s interface.

-

Correctly type textual content and numbers.

-

Press the Date field to put the actual day automatically or change it manually.

-

Apply Signature Wizard to design your personalized e-signature and certify within minutes.

-

Use the IRS directions if you still have questions..

-

Click on Done to save the changes..

-

Go on to print the record out, save, or send it via Email, text messaging, Fax, USPS without exiting your web browser.

Keep your KY 51A111 securely. You should make sure that all your appropriate paperwork and data are in order while bearing in mind the deadlines and tax regulations set by the IRS. Do it easy with US Legal Forms!

How to edit KY 51A111: customize forms online

Check out a single service to deal with all your paperwork with ease. Find, edit, and complete your KY 51A111 in a single interface with the help of smart instruments.

The times when people needed to print out forms or even write them manually are gone. Nowadays, all it takes to get and complete any form, like KY 51A111, is opening a single browser tab. Here, you can find the KY 51A111 form and customize it any way you need, from inserting the text directly in the document to drawing it on a digital sticky note and attaching it to the record. Discover instruments that will simplify your paperwork without extra effort.

Click the Get form button to prepare your KY 51A111 paperwork rapidly and start modifying it instantly. In the editing mode, you can easily complete the template with your details for submission. Just click on the field you need to change and enter the data right away. The editor's interface does not need any specific skills to use it. When finished with the edits, check the information's accuracy once more and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use Additional instruments to customize your form:

- Use Cross, Check, or Circle instruments to pinpoint the document's data.

- Add text or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding instruments.

- Add a date, initials, or even an image to the document if necessary.

- Use the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual components to your file.

Preparing KY 51A111 paperwork will never be confusing again if you know where to search for the suitable template and prepare it easily. Do not hesitate to try it yourself.

Use tax is a sales tax on purchases made outside one's state of residence for taxable items that will be used, stored or consumed in one's state of residence and on which no tax was collected in the state of purchase.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.