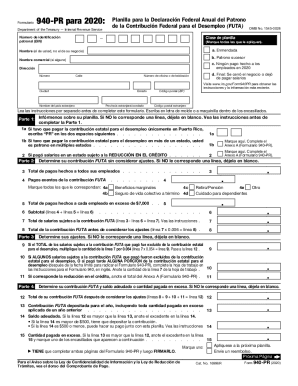

Get Irs 940-pr 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 940-PR online

How to fill out and sign IRS 940-PR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If people aren?t connected to document administration and law procedures, filling out IRS forms can be extremely demanding. We understand the value of correctly completing documents. Our service proposes the utility to make the mechanism of processing IRS documents as easy as possible. Follow this guideline to quickly and accurately fill out IRS 940-PR.

The best way to submit the IRS 940-PR on the Internet:

-

Click on the button Get Form to open it and start editing.

-

Fill in all required fields in the selected doc making use of our powerful PDF editor. Turn the Wizard Tool on to finish the procedure even simpler.

-

Check the correctness of filled details.

-

Include the date of finishing IRS 940-PR. Make use of the Sign Tool to create a special signature for the record legalization.

-

Finish modifying by clicking Done.

-

Send this record to the IRS in the easiest way for you: via email, utilizing digital fax or postal service.

-

You are able to print it on paper if a copy is required and download or save it to the favored cloud storage.

Using our ultimate solution will make expert filling IRS 940-PR possible. We will make everything for your comfortable and quick work.

How to edit IRS 940-PR: customize forms online

Have your stressless and paper-free way of editing IRS 940-PR. Use our reliable online option and save tons of time.

Drafting every form, including IRS 940-PR, from scratch takes too much effort, so having a tried-and-tested solution of pre-drafted document templates can do magic for your efficiency.

But editing them can be struggle, especially when it comes to the files in PDF format. Luckily, our huge library includes a built-in editor that enables you to quickly fill out and edit IRS 940-PR without the need of leaving our website so that you don't need to lose your precious modifying your paperwork. Here's what you can do with your document using our solution:

- Step 1. Locate the required document on our website.

- Step 2. Hit Get Form to open it in the editor.

- Step 3. Use our professional modifying tools that let you insert, remove, annotate and highlight or blackout text.

- Step 4. Create and add a legally-binding signature to your document by using the sign option from the top toolbar.

- Step 5. If the form layout doesn’t look the way you need it, utilize the tools on the right to remove, add, and re-order pages.

- step 6. Insert fillable fields so other persons can be invited to fill out the form (if applicable).

- Step 7. Share or send the form, print it out, or choose the format in which you’d like to get the document.

Whether you need to execute editable IRS 940-PR or any other form available in our catalog, you’re on the right track with our online document editor. It's easy and secure and doesn’t require you to have special skills. Our web-based tool is set up to handle virtually everything you can imagine when it comes to document editing and execution.

No longer use outdated way of working with your documents. Choose a more efficient option to help you simplify your tasks and make them less dependent on paper.

Get form

2019 FUTA Tax Rates. The 2019 FUTA tax rate is 6% on the first $7,000 in wages that you paid to an employee during the calendar year. After the first $7,000 in annual wages, you don't have to pay taxes. For example, the FUTA tax for an employee who receives $6,000 in annual wages would be $360.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.