Loading

Get Mn Dor M4 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M4 online

Filling out the MN DoR M4 form online can streamline your tax filing process and ensures accurate submission. This guide will provide step-by-step instructions to assist you in completing each section of the form effectively.

Follow the steps to complete the MN DoR M4 form online.

- Click ‘Get Form’ button to obtain the document and open it in your browser.

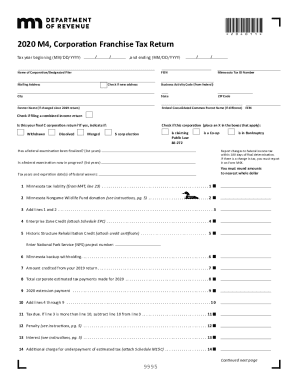

- Enter the tax year by filling in the dates for the beginning and ending (MM/DD/YYYY). This information is essential as it determines the period for which you are filing.

- Fill in the name of the corporation or designated filer at the top of the form. Ensure the name matches official records.

- Provide the FEIN (Federal Employer Identification Number) which is necessary for tax identification. If you do not have one, please apply through the IRS.

- Enter the mailing address for the corporation. If it has changed, check the box indicating a new address. Complete the Minnesota Tax ID Number and the Business Activity Code as noted on federal forms.

- Specify the city, state, and ZIP code corresponding to the corporation's address.

- If the corporation's name has changed since the last return, provide the former name in the designated field.

- Indicate whether this is the final C corporation return by checking the appropriate box and providing any relevant details.

- Review any checkboxes related to the corporation's status such as if it has been withdrawn, dissolved, merged, or made an S corporation election.

- Fill in the necessary lines for Minnesota tax liability, animal fund donations, and relevant credits or adjustments as required. Ensure all amounts are rounded to the nearest whole dollar.

- Complete lines calculating tax due, penalties, and interest. Make sure to reference any attached schedules needed for specific credits.

- Indicate the payment method by selecting either electronic options or check, following the specific instructions provided.

- Complete the signature section, ensuring that an authorized person signs and dates the form. Include any preparer's information if applicable.

- After filling out all required fields, you can save changes, download the completed form, print it, or share it depending on your filing needs.

Complete your MN DoR M4 tax return online today for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Social Security income included in Minnesota taxable income (after subtraction) is taxed at the same rate as other kinds of income 5.35 percent, 7.05 percent, 7.85 percent, or 9.85 percent depending on the total amount of taxable income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.