Loading

Get Tx Trs 228a 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TRS 228A online

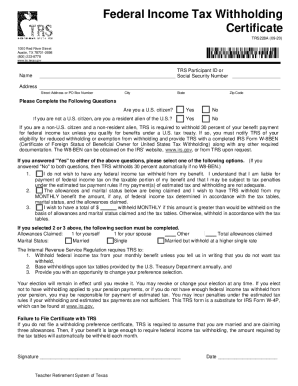

The TX TRS 228A is an essential form for managing federal income tax withholding for participants of the Teacher Retirement System of Texas. This guide provides a clear, step-by-step process to help users fill out the form accurately and efficiently online.

Follow the steps to complete the TX TRS 228A online.

- Press the ‘Get Form’ button to access the TX TRS 228A form in your online editor.

- Begin by entering your name and TRS Participant ID or Social Security Number in the designated fields. Make sure to check for any typographical errors.

- Next, provide your complete address, including street address or PO Box, city, state, and zip code.

- Respond to the questions regarding your citizenship status. Indicate 'Yes' or 'No' for being a U.S. citizen and whether you are a resident alien.

- If applicable, select the option regarding federal income tax withholding preferences: '1' for no withholding, '2' for withholding based on allowances and marital status, or '3' for a specified monthly amount.

- If you selected options 2 or 3, fill out the allowances claimed and your marital status. Indicate the number of allowances for yourself and your spouse.

- Carefully read the IRS regulations related to withholding and your rights to modify your selection as necessary.

- Finally, ensure your signature and the date are correctly entered at the end of the form before proceeding to save changes, download, print, or share the completed form.

Complete your TX TRS 228A form online today to ensure proper management of your federal income tax withholding.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Rule of 80 It means that once an employee's age and years of service total 80, the employee is eligible to retire. Here is an example. An employee begins working for a government agency at age 27. The organization's retirement system operates under the rule of 80.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.