Loading

Get Irs 990 - Schedule F 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule F online

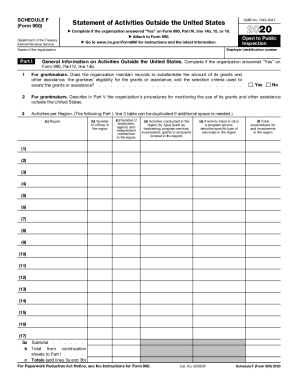

The IRS 990 - Schedule F is a crucial form used by organizations that conduct activities outside the United States. This guide provides clear instructions on how to complete the form online, ensuring that users can navigate each section with confidence.

Follow the steps to complete the IRS 990 - Schedule F online.

- Use the ‘Get Form’ button to access the IRS 990 - Schedule F form and open it in the editor.

- Begin by entering your organization's employer identification number and name at the top of the form. Ensure these details match your official records, as they are essential for accurate processing.

- Complete Part I, which pertains to the statement of activities outside the United States. Answer the questions regarding your organization’s grantmaking practices and monitoring procedures. If additional space is needed for any section, you may duplicate the relevant table.

- Proceed to Part II to report on grants and other assistance provided to organizations outside the United States. List the organizations, specify the purpose of each grant, and include details such as amounts and methods of disbursement.

- If applicable, move to Part III to document any grants or assistance provided to individuals outside the United States. Include information about the type of assistance, number of recipients, and amounts involved.

- In Part IV, answer questions regarding foreign relationships and compliance requirements concerning U.S. transfers to foreign entities. This section requires careful attention to ensure all obligations are met.

- Finally, complete Part V, providing any supplementary information as required. This may involve details on your organization's accounting methods and a summary of activities conducted internationally.

- Once all sections are filled out correctly, review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start filling out the IRS 990 - Schedule F online today to ensure your organization's compliance.

Mail your return to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0027. If your organization's principal business, office, or agency is located in a foreign country or a U.S. possession, send the return to the Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.